Half-Year Results Fiscal Year 2022/23 of the Barry Callebaut Group

Half-Year Results Fiscal Year 2022/23 of the Barry Callebaut Group

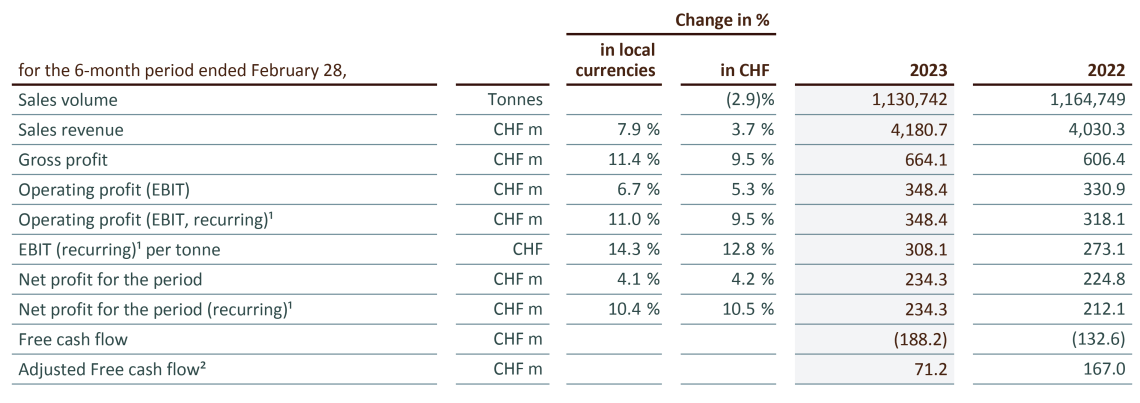

- Progressive volume recovery in second quarter (-0.5%), limiting sales volume decline to -2.9% in Half Year 2022/23

- Sales revenue of CHF 4.2 billion, up +7.9% in local currencies (+3.7% in CHF)

- Strong operating profit (EBIT) of CHF 348.4 million, up +11.0% in local currencies (+9.5% in CHF), compared to prior-year EBIT recurring1. EBIT reported up +6.7% in local currencies (+5.3% in CHF)

- Net profit of CHF 234.3 million, up +10.4% in local currencies (+10.5% in CHF) compared to prior-year Net profit recurring1. Net profit reported up +4.1% in local currencies (+4.2% in CHF)

- Solid cash generation with adjusted Free cash flow2 of CHF 71.2 million

- Updated volume forecast expected to result in flat to modest volume growth for the Full Year 2022/23 with continued strong operating profitability (EBIT)

- Confirmation of guidance for 3-year period 2023/24 to 2025/263

In the first six months of the fiscal year we delivered strong profitability, reflecting the strength of our business model, which includes continued cost leadership in a highly inflationary environment, and good product mix. Against a high comparator, we witnessed progressive volume recovery, albeit slower than expected. This was due to the temporarily limited availability of our global brands and weaker than expected customer demand in an inflationary environment. I want to thank all colleagues for their commitment and passion in driving the business forward.

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, reported sales volume of 1,130,742 tonnes in the first six months of fiscal year 2022/23 (ended February 28, 2023). Following a slow start in the first quarter (-5.1%) due to the residual effects from the Wieze ramp-up, volume progressively recovered in the second quarter (-0.5%), resulting in a volume decline of -2.9% in the first half year. Chocolate volume picked up in the second quarter in Region EMEA (+1.8%, Half Year -3.7%) and remained about stable in Region Asia Pacific (+0.4%, Half Year +0.3%). Volume declined in Region Americas (-6.6%, Half Year -4.4%). Overall chocolate volume in the first six months declined (-3.6%). Excluding the Wieze ramp-up effect, volume performance was in line with the underlying global chocolate confectionery market (-1.8%)4. The Group's key growth drivers turned positive in the second quarter: Outsourcing +3.0% (Half Year +1.4%), Emerging Markets +2.1% (Half Year -1.0%) and Gourmet & Specialties +0.4% (Half Year -5.8%). Global Cocoa volume normalized and amounted to 227,773 tonnes, flat (-0.1%) compared to prior-year period.

Sales revenue amounted to CHF 4,180.7 million, up +7.9% in local currencies (+3.7% in CHF). The increase was driven by higher raw material prices and the inflationary environment, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business, and by the positive product mix.

Gross profit amounted to CHF 664.1 million, up +11.4% in local currencies (+9.5% in CHF). The negative volume impact, due to the residual effects from the Wieze ramp-up in the first quarter, was more than compensated for by the strong product mix effect and the positive contribution from the cocoa business.

Operating profit (EBIT) was strong and amounted to CHF 348.4 million, an increase of +11.0% in local currencies (+9.5% in CHF) compared to prior-year EBIT recurring5, well ahead of volume. EBIT per tonne increased to CHF 308 from CHF 273 in prior year recurring5, as a result of the positive product mix.

Net profit for the period amounted to CHF 234.3 million, up +10.4% in local currencies (+10.5% in CHF) compared to prior-year Net profit recurring5. The increase was supported by strong operating profit (EBIT), partially offset by slightly higher Net financing cost due to higher benchmark interest rates and slightly higher Income tax expenses of CHF -53.9 million. The effective tax rate amounted to 18.7%.

Net working capital increased to CHF 1,699.3 million from CHF 1,598.8 million in the prior-year period. Receivables and inventory mainly increased amidst raw materials price inflation and the latter additionally by the early harvest of the main cocoa bean crop. The effects were partially offset by higher payables.

Free cash flow generation continued to be solid and amounted to CHF -188.2 million, compared to CHF -132.6 million in prior-year period, despite the increasing prices of raw materials. Adjusted for the effect of cocoa beans considered as readily marketable inventories (RMI), the adjusted Free cash flow amounted to CHF 71.2 million (February 28, 2022: CHF 167.0 million).

Net debt remained about stable at CHF 1,581.5 million compared to CHF 1,594.3 million in the prior-year period. Taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), the adjusted Net debt decreased to CHF 368.4 million, compared to CHF 561.1 million in the prior-year period.

1 Prior year excluding the recovery of indirect tax credits in Brazil of CHF +12.8 million in Operating profit (EBIT) and CHF +12.7 million in Net profit.

2 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

3 On average for the 3-year period 2023/24 to 2025/26: +4-6% volume growth and +8-10% EBIT growth in local currencies, with further ROIC improvement, barring any major unforeseeable events.

4 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2022 – January 2023. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

5 Prior year excluding the recovery of indirect tax credits in Brazil of CHF +12.8 million in Operating profit (EBIT) and CHF +12.7 million in Net profit.

Outlook – Continued strong operating profitability, updated volume forecast for Full Year 2022/23

Looking ahead, CFO Ben De Schryver said:

We are confident to deliver continued strong operating profitability in the second half of the year. Due to the delayed volume growth, we now forecast the volume growth to be flat to modest for the Full Year 2022/23. Over the three years guidance6 period we expect average volume growth to be below 5% with EBIT strongly outperforming.

Strategic milestones

Innovation: Barry Callebaut presented in January 2023 the top chocolate trends for 2023 and beyond. The regional “Top Chocolate Trends” are available for Europe, North America, Latin America and Asia Pacific (please see website for further details), and help chocolate professionals keep their fingers on the pulse of the market.

Also in January 2023, global brand Cacao Barry launched the Cacao Powders collection, a range of high performance cocoa powders for chocolatiers and pastry chefs, with improved texture, color and taste.

In March 2023, Barry Callebaut's 2nd generation chocolate was recognized as a finalist in four categories of the World Food Innovation Awards at the 2023 International Food & Drink Event in London. The breakthrough innovation allows chocolate lovers to indulge in the purity of cocoa flavors. The new Dark and Milk chocolates are based on a new product design, which follows the principle 'cocoa first, sugar last' and only contain these two ingredients, plus dairy in the case of Milk chocolate.

Cost Leadership: In January 2023, Moody's Investors Service changed the Group’s long-term issuer rating outlook to ‘positive’ from ‘stable’. The rating outlook for all senior unsecured long-term bonds issued by Barry Callebaut Services N.V. has also been changed to ‘positive’ from ‘stable’. At the same time, Moody’s affirmed the ‘Baa3’ ratings. Moody's justified the rating action with its expectation of a further strengthening of Barry Callebaut's credit metrics over the next 12 to 18 months.

Sustainability: In March 2023, Barry Callebaut announced a long-term agroforestry project with Nestlé in Côte d’Ivoire. The project aims to roll out 11,500 hectares of agroforestry, which includes payments for ecosystem services to more than 6,000 farmers. The recently signed agreement is an important milestone in Barry Callebaut's journey to scale its agroforestry approach by partnering with customers across cocoa origins, thus creating value for the farmers and removing carbon within Barry Callebaut's and its customers' supply chains.

6 On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

Regional/Segment performance

Region EMEA – Improving volume momentum and strong profitability

In Region EMEA (Europe, Middle East and Africa) sales volume amounted to 517,593 tonnes, down

-3.7% in the first six months of the fiscal year. Growth momentum picked up in the second quarter (+1.8%) and was well above the declining underlying global confectionery market (-2.4%; Half Year -3.2%)7. Food Manufacturers volume further recovered in the second quarter across the Region in a challenging market environment. Gourmet & Specialties volume was back to sound volume growth in the second quarter, supported by both Western and Eastern Europe. Sales revenue amounted to CHF 1,842.5 million, up +15.8% in local currencies (+8.0% in CHF). Operating profit (EBIT) increased to CHF 205.1 million, up +10.3% in local currencies (+6.7% in CHF), as a result of the Group's ability to pass on higher costs amid the general inflationary environment and a positive mix effect.

Region Americas – Strong profitability despite soft volume

In an overall soft underlying chocolate confectionery market (-0.5%)7 and against a high comparator in the prior-year period, sales volume in Region Americas declined by -4.4% to 304,032 tonnes. Food Manufacturers volume suffered from weaker than expected customer demand. Gourmet & Specialties volume continued its positive growth in Latin America, while North America suffered from the limited availability of global brands, particularly in the first quarter, and a weak performance of local brands in the second quarter. Sales revenue amounted to CHF 1,114.9 million, up +5.0% in local currencies (+9.1% in CHF). Despite lower volume the continued focus on the acceleration up the value ladder supported strong profitability, leading to an Operating profit (EBIT) of CHF 116.2 million, up +5.8% in local currencies (+11.2% in CHF) compared to prior-year EBIT recurring8.

Region Asia Pacific – Flat volume temporarily impacting profitability

In Region Asia Pacific sales volume remained flat (+0.3%) at 81,344 tonnes in the first six months under review. The underlying chocolate confectionery market grew by +2.5%7 according to Nielsen, however this data reflects a limited number of markets. Food Manufacturers growth remained in the low single-digit range, due to the inflationary impact on volume in Indonesia and Japan and a weakening demand in particular in the bakery and biscuit segment. Gourmet & Specialties volume steadily improved in the second quarter, supported by the growth of local brands in markets such as India and Indonesia. Sales revenue amounted to CHF 276.0 million, up +5.1% in local currencies (+0.5% in CHF). Operating profit (EBIT) amounted to CHF 28.7 million, a slight decline of -4.2% in local currencies (-6.8% in CHF) as a result of a softer volume recovery and a shift in mix.

Global Cocoa – Normalized volume growth and good profitability

Sales volume in Global Cocoa recovered in the second quarter (+2.6%), leading to a normalized flat (-0.1%) volume of 227,773 tonnes in the first six months of the fiscal year. Sales revenue amounted to CHF 947.3 million, down -1.5% in local currencies (-7.8% in CHF). As expected, Operating profit (EBIT) improved substantially to CHF 52.1 million, up +29.8% in local currencies (+30.9% in CHF) compared to prior-year EBIT recurring8, which was impacted by an imbalanced cocoa market.

Price developments of the most important raw materials

During the first six months of fiscal year 2022/23, terminal market9 prices for cocoa beans

fluctuated between GBP 1,822 and GBP 2,144 per tonne and closed at GBP 2,129 per tonne on

February 28, 2023. On average, cocoa bean prices increased by +11.3% versus the prior-year period. The global bean supply and demand forecast for 2022/23 indicates a deficit.

Sugar prices in Europe increased on average by +83.4% during the period under review, mainly due to low stocks coupled with a poor crop and high energy prices. The world market price for sugar increased on average by +5.3% on the back of lower sugar exports from India.

Dairy prices decreased on average by -6.1% during the first six months of fiscal year 2022/23. Milk

supply increased across the globe thanks to strong milk payments to farmers, while consumer

demand slowed due to the persistent high inflation.

7 Source: Nielsen volume growth excluding e-commerce - September 2022 to January 2023, data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption. Nielsen Asia Pacific volume growth of +2.5% includes 6 countries: Australia, China, India, Indonesia, Japan and South Korea. When compared to the same markets, Region Asia Pacific volume growth was in line.

8 Prior year excluding the recovery of indirect tax credits in Brazil of CHF +12.8 million in Operating profit (EBIT) and CHF +12.7 million in Net profit. The prior-year effect is split as follows on regional level: EBIT recurring in Region Americas excluded CHF +2.4 million and in Global Cocoa excluded CHF +10.4 million.

9 Source: London terminal market prices for 2nd position, September 2022 to February 2023. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Media and Analyst Conference of the Barry Callebaut Group

| Date: | Wednesday, April 5, 2023, at 10:00 – 11:30 CEST |

| Location: | SIX Convention Point, Pfingstweidstrasse 110, 8005 Zurich |

This will be a physical conference hosted by Ben De Schryver, CFO, which can also be followed via

telephone or webcast.

Media Assets

Financial Calendar for Fiscal Year 2022/23:

(September 1, 2022, to August 31, 2023)

| Forever Chocolate: Impact beyond 2025, live event | May 10, 2023 |

| Forever Chocolate: Impact beyond 2025, live investor Q&A | May 11, 2023 |

| 9-Month Key Sales Figures 2022/23 | July 13, 2023 |

| Full-Year Results 2022/23 | November 1, 2023 |

| Annual General Meeting 2022/23 | December 6, 2023 |

Downloads

10 Financial performance measures, not defined by IFRS, are defined in the Annual Report 2021/22 on page 175.

11 Prior year EBITDA and Operating profit (EBIT) recurring at Group level excluded CHF +12.8 million and Net profit for the period recurring excluded CHF +12.7 million for the recovery of indirect tax credits in Brazil for prior fiscal periods. The effect is split on regional level: EBIT recurring in Region Americas excluded CHF +2.4 million and in Global Cocoa excluded CHF +10.4 million.

12 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

About Barry Callebaut Group:

With annual sales of about CHF 8.1 billion (EUR 7.8 billion / USD 8.6 billion) in fiscal year 2021/22, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 65 production facilities worldwide and employs a diverse and dedicated global workforce of more than 13,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Follow the Barry Callebaut Group: