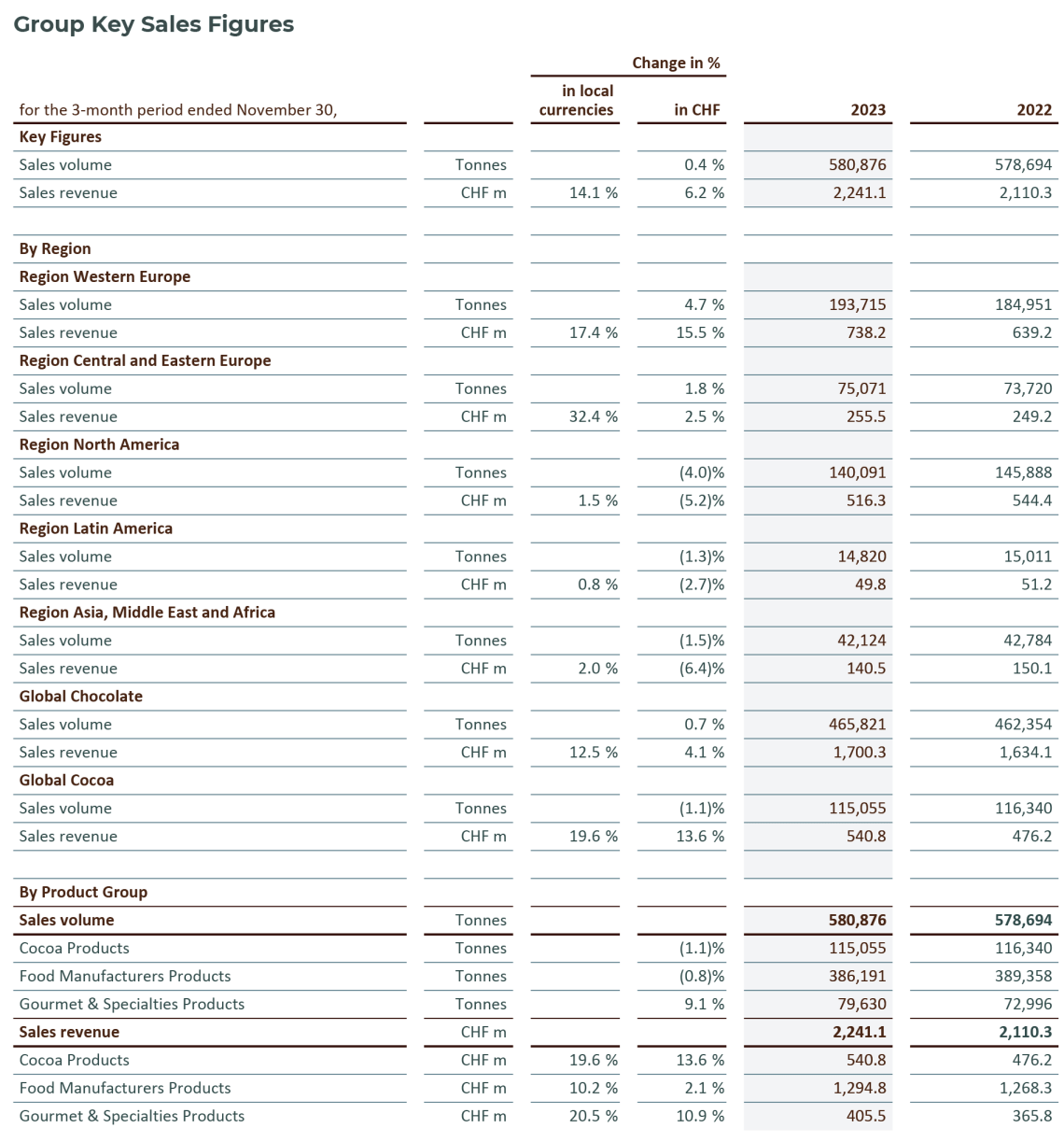

As a strategic move under the BC Next Level operating model, Barry Callebaut has transitioned from three to five chocolate regions to enhance proximity to markets and customers. The new regions now include Western Europe, Central & Eastern Europe, North America, Latin America, and Asia Pacific Middle East & Africa.

Region Western Europe

Sales volume in Western Europe grew +4.7% to 193,715 tonnes ahead of the declining underlying regional chocolate confectionery market (-3.4%)2, but against the lower prior-year comparison base due to the Wieze incident. While Food Manufacturers' volume performance was impacted by the challenging environment for FMCG customers, the region was able to capture the benefit of the consumer shift to private label products. Sales revenue amounted to CHF 738.2 million up +17.4% in local currencies (+15.5% in CHF).

Region Central and Eastern Europe

Sales volume in the region grew +1.8% to 75,071 tonnes in the first three months of fiscal year 2023/24 ahead of the chocolate confectionery market (+0.3%)2. While the FMCG performance was challenged, Gourmet & Specialties saw strong demand, with volume growth from industrial and artisanal customers, particularly in Turkey. South Eastern Europe benefited from existing and new partnerships. Sales revenue in the region amounted to CHF 255.5 million, up +32.4% in local currencies (+2.5% in CHF).

Region North America

Sales volume in North America experienced a slow start with a decline of -4.0% to 140,091 tonnes in the first three months of fiscal year 2023/24, in a declining, underlying regional chocolate confectionery market (-6.6%)2. Food Manufacturers in the region were impacted by weaker consumer demand impacting FMCG growth, partly offset by new business. Gourmet & Specialties saw signs of recovery, including strong growth in Mexico. Sales revenue in the region amounted to CHF 516.3 million, up +1.5% in local currencies (-5.2% in CHF).

Region Latin America

Sales volume in Region Latin America declined -1.3% to 14,820 tonnes in the first three months of fiscal year 2023/24, in a regional chocolate confectionery market up +1.1%2. Mid single digit growth in Brazil was offset by weaker demand in the rest of the region. Sales revenue amounted to CHF 49.8 million, up +0.8% in local currencies (-2.7% in CHF).

Region Asia, Middle East and Africa

Sales volume in the region declined by -1.5% to 42,124 tonnes in the first three months of fiscal year 2023/24 in line with the underlying regional chocolate confectionery market (-1.6%)2. FMCG customers saw headwinds as price increases impacted consumer demand. The ongoing softer macroeconomic environment in China also hindered volume growth and to a lesser extent this was also seen in Indonesia. However, this was partly offset by high single digit growth in other country clusters, with Gourmet brands driving growth in India, South East Asia and Middle East & North Africa. Sales revenue amounted to CHF 140.5 million, up +2.0% in local currencies (-6.4% in CHF).

Global Cocoa

Sales volume in Global Cocoa amounted to 115,055 tonnes, down by -1.1% in the first three months of fiscal year 2023/24. Sales revenue amounted to CHF 540.8 million, up +19.6% in local currencies (+13.6% in CHF).

2 Source: Nielsen volume growth excluding e-commerce – September 2023 to October/November 2023, data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

Price developments of key raw materials

During the first three months of fiscal year 2023/24, terminal market3 prices for cocoa beans fluctuated between GBP 2,896 and GBP 3,572 per tonne and closed at GBP 3,558 per tonne on November 30, 2023. On average, cocoa bean prices increased by +68% versus the prior-year period. Expectations of a supply deficit on the back of a lower 2023/24 West African crop were largely confirmed by lower cocoa bean arrivals in Ivory Coast and Ghana, leading both New York and London Cocoa to continue their move higher, with Cocoa bean differential markets also increasing. Despite the continued terminal market increase, the combined ratio (calculated with Western Europe cocoa products prices) remained fairly unchanged throughout this period at around 3.15x, primarily thanks to a slight increase in Cocoa Butter ratios. This was still lower than the same period last year, when the combined ratio was at an average of 3.6x.

The world market price for sugar was on average +40.5% higher than in the prior-year period as the result of an emerging world balance deficit. The projected deficit was due to large revisions in crop output in El Niño-impacted regions like in India and Thailand, but the price eased after the quarter end. In Europe, sugar prices were on average -16.2% lower than in the prior-year period due to the expected gains in the 2023/24 beet sugar output, and the stronger emergence of cheaper Ukrainian sugar imports.

Dairy prices decreased on average by -26.5% compared to the first three months of the prior year but increased on average +7.7% versus the prior quarter. In a quarter during which North Hemisphere (US & Europe) milk output turned markedly negative versus 2022 levels, dairy markets around the world reacted accordingly, with dairy prices during the period rising across the board and despite concerns around weak demand.

3 Source: London terminal market prices for 2nd position, September 2023 to October/November 2023. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Financial Calendar for Fiscal Year 2023/24

(September 1, 2023 to August 31, 2024)