Full-Year Results Fiscal Year 2019/20

of the Barry Callebaut Group

Full-Year Results Fiscal Year 2019/20

of the Barry Callebaut Group

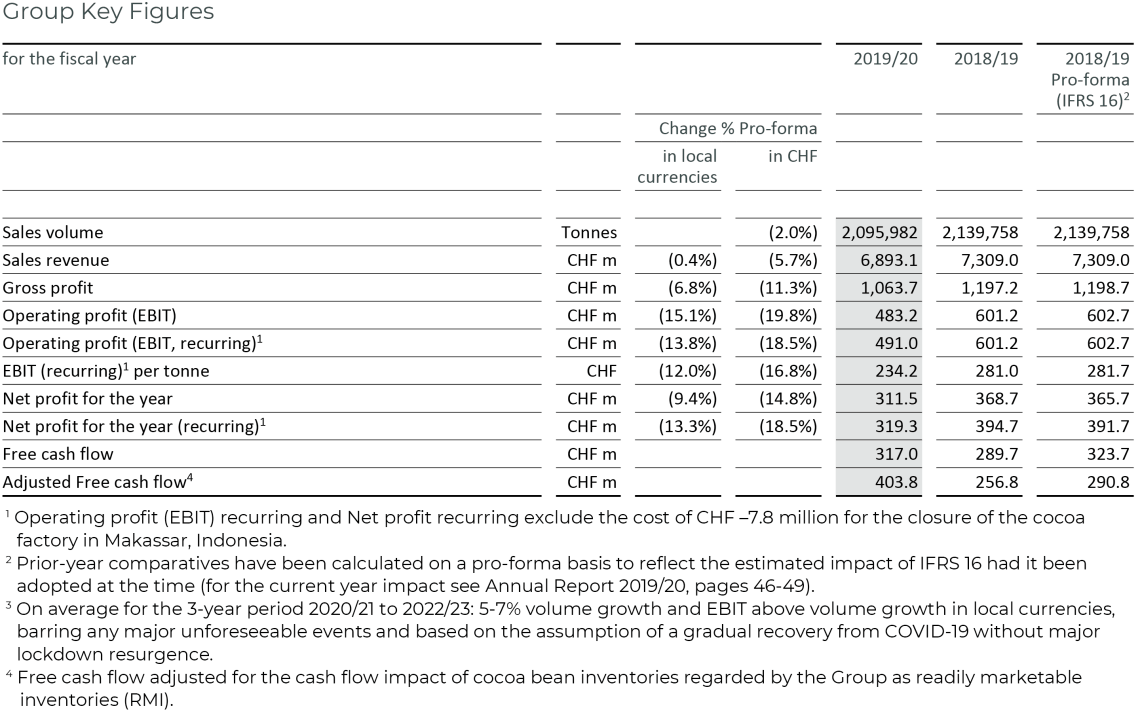

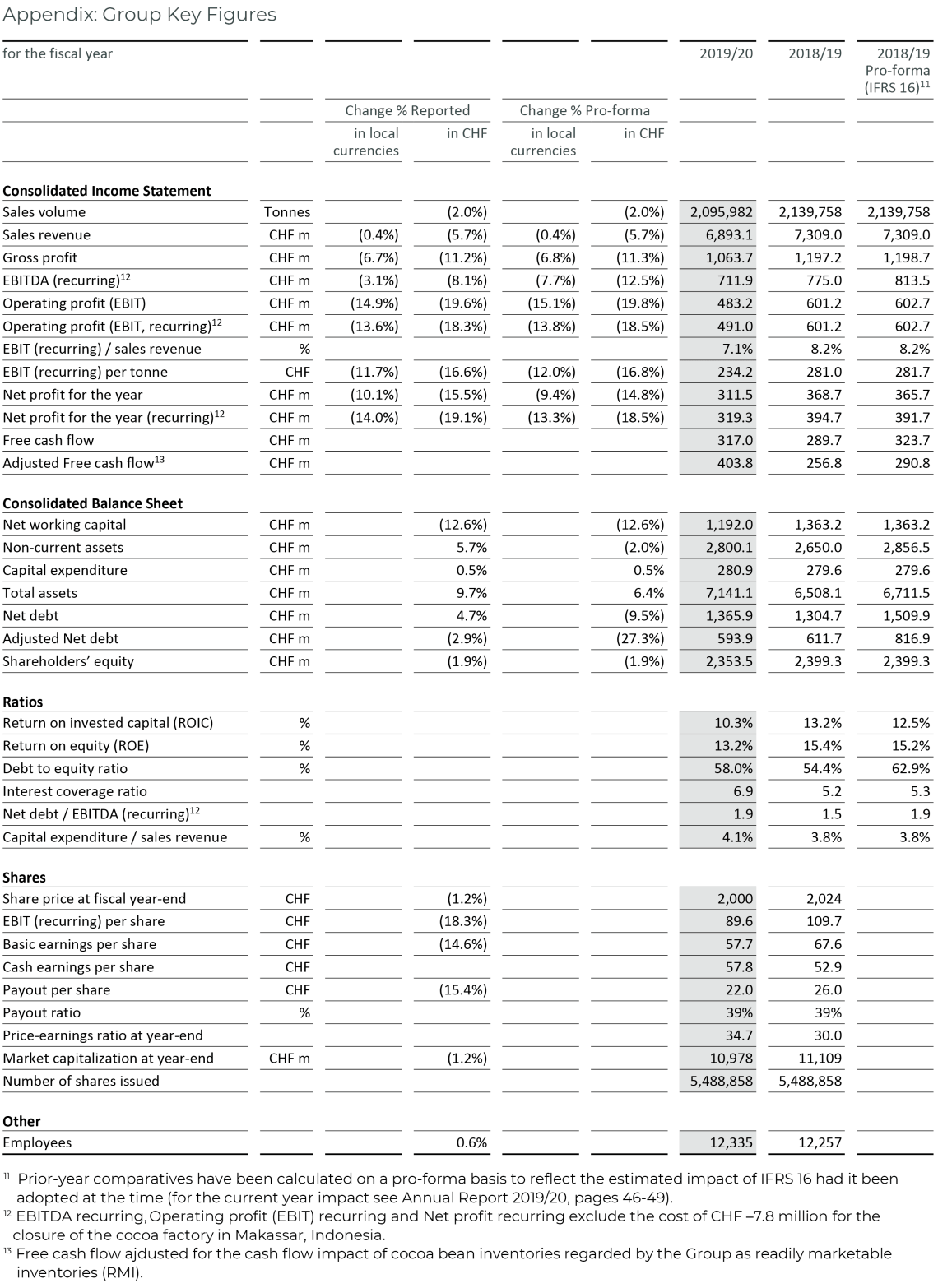

- Sales volume down –2.0%, progressive volume recovery in fourth quarter

- Sales revenue of CHF 6.9 billion, down –0.4% in local currencies (–5.7% in CHF)

- Operating profit (EBIT) recurring1 of CHF 491.0 million, down –13.8%2 in local currencies (–18.5%2 in CHF)

- Net profit recurring1 of CHF 319.3 million, down –13.3%2 in local currencies (–18.5%2 in CHF)

- Strong Free cash flow of CHF 317 million

- Confident on mid-term guidance3

- CFO Remco Steenbergen to leave; Ben De Schryver appointed as CFO effective January 1, 2021 (see separate news release)

- Board member Suja Chandrasekaran will not stand for reelection. Yen Yen Tan proposed as new member of the Board of Directors

- Proposed dividend: CHF 22.00 per share, a stable payout ratio of 39%

1 Operating profit (EBIT) recurring and Net profit recurring exclude the cost of CHF –7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

2 Prior-year comparatives have been calculated on a pro-forma basis to reflect the estimated impact of IFRS 16 had it been adopted at the time (for the current year impact see Annual Report 2019/20, pages 46-49).

3 On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events and based on the assumption of a gradual recovery from COVID-19 without major lockdown resurgence.

4 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

I am proud of the solid set of results and strengthened balance sheet that we managed to deliver in unprecedented times. They are testimony to the strength and resilience of Barry Callebaut, its employees and its culture. Our focus on care, continuity and cash helped us to safeguard the health of our people and communities, to serve our customers well at a time when they need it most, and to enhance the financing of our company.

In fiscal year 2019/20 (ended August 31, 2020) the Barry Callebaut Group – the world’s leading manufacturer of high-quality chocolate and cocoa products – saw its sales volume decline by –2.0% to 2,095,982 tonnes, as a result of the COVID-19 pandemic. After a –14.3% decline in the third quarter at the height of the pandemic, sales volume showed – as anticipated – a recovery in the fourth quarter (–4.3%). Sales volume in the chocolate business declined by –2.1% in the fiscal year under review. The underlying global chocolate confectionery market was down –0.3% in the year under review according to Nielsen5. Sales volume in Global Cocoa was down –2.0%.

Sales revenue declined by –0.4% in local currencies (–5.7% in CHF) to CHF 6,893.1 million.

Gross profit amounted to CHF 1,063.7 million, a decline of –6.8% in local currencies (–11.3% in CHF) compared to prior year.6 The volume decline in the second half of the year due to the COVID-19 lockdowns, particularly in Gourmet & Specialties, had an adverse impact on the product mix.

Operating profit (EBIT) recurring7 amounted to CHF 491.0 million, a decrease of –13.8% in local currencies (–18.5% in CHF), compared to prior year.6 Currencies had a strong negative translation effect of CHF –29 million. As announced with the Half-Year Results, the closure of the cocoa factory in Makassar, Indonesia, had a negative impact of CHF –7.8 million. As a result, the reported EBIT amounted to CHF 483.2 million, down –15.1% in local currencies (–19.8% in CHF) compared to prior year.6 The recurring EBIT per tonne amounted to CHF 234 compared to CHF 282 in prior year. 6

Net profit for the year recurring7 amounted to CHF 319.3 million, down –13.3% in local currencies (–18.5% in CHF) compared to prior year.6 The reported Net profit for the year amounted to CHF 311.5 million, down –9.4% in local currencies (–14.8% in CHF) compared to prior year. 6 The net finance costs decreased to CHF 102.4 million from CHF 148.4 million in prior year, which included a CHF 33.0 million one-off expense for the early repayment of the EUR 250 million Senior Note. The income tax expenses amounted to CHF –69.2 million in 2019/20, which corresponds to an effective tax rate of 18.2% (18.6% in prior year).

Net working capital decreased to CHF 1,192.0 million from CHF 1,363.2 million in prior year. This was the result of good working capital management across the board and the benefit of lower receivables due to a COVID-19 impact on volume. This more than offset the impact of higher inventories due to rising cocoa bean prices.

Net debt decreased to CHF 1,365.9 million compared to CHF 1,509.9 million in prior year.6 Taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), adjusted Net debt decreased to CHF 593.9 million from CHF 816.9 million in prior year.6

Strong Free cash flow generation continued and amounted to CHF 317 million compared to CHF 324 million in prior year.6 Adjusted for the effect of cocoa beans considered as readily marketable inventories (RMI), the adjusted Free cash flow amounted to CHF 404 million compared to CHF 291 million in prior year.

5 Source: Nielsen volume growth excluding e-commerce, September 2019 – August 2020 – 25 countries. Nielsen data only partially reflects the out-of-home and impulse consumption, which was heavily impacted by the lockdowns due to COVID-19.

6 Prior-year comparatives have been calculated on a pro-forma basis to reflect the estimated impact of IFRS 16 had it been adopted at the time (for the current year impact see Annual Report 2019/20, pages 46-49).

7 Operating profit (EBIT) recurring and Net profit recurring exclude the cost of CHF –7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

COVID-19 update

Since the beginning of the pandemic, Barry Callebaut has succeeded in maintaining a high level of safety for its people and in keeping its operations running, thanks to the precautionary measures it put in place early on. Barry Callebaut has created dedicated expert teams at global and regional level who are monitoring the COVID-19 developments across the globe on a daily basis. If required, they will adjust the precautionary measures in place based on their own insights as well as on the guidance from public authorities. The overall progression of the COVID-19 pandemic remains volatile at this stage. However, the last nine months have provided the Group with additional learnings on managing safety and continuity. Thanks to these insights, new ways of working and the Group’s capability to cater to the latest customer trends, Barry Callebaut will continue to enable the growth of its customers through innovation and service.

Outlook – confident of delivering on mid-term guidance

Looking ahead, CEO Antoine de Saint-Affrique said:

Although markets are still volatile, we will further pursue expansion and drive for new opportunities, thanks to our continued focus on customers and our strong innovation pipeline. This, together with our solid financial basis, supports the confidence in our mid-term guidance.

Strategic milestones achieved in fiscal year 2019/20

Expansion: In July 2020, Barry Callebaut completed the acquisition of GKC Foods (Australia), a producer of chocolate, coatings and fillings. Barry Callebaut also entered into a long-term outsourcing agreement with a leading Australian snacking company, to supply them with 100% sustainable chocolate. This outsourcing agreement, combined with the recent acquisition, will enable the Group to accelerate growth in the two still largely captive markets of Australia and New Zealand. In June 2020, Barry Callebaut added a fourth production line to its Senoko plant in Singapore, a significant contribution to the Group’s largest chocolate factory in Region Asia Pacific, to meet increasing demand in the Asia-Pacific markets.

In Region EMEA, Barry Callebaut signed in May 2020 an agreement with a large chocolate confectionery manufacturer in Eastern Europe, for the long-term supply of compound and chocolate. The ramp-up starts in the first quarter of fiscal year 2020/21. Earlier this year, Barry Callebaut inaugurated the revamped CHOCOLATE ACADEMY™ Center in Banbury, as part of the Group’s growth strategy in the UK, which is one of Europe’s biggest chocolate confectionery markets in volume terms.

The Group also deepened in October 2020 its presence in Latin America by laying the foundation stone for a new cocoa sourcing facility in Duran, Ecuador. With this investment, the Group intends to seize the opportunities in Ecuador, the world’s third largest and fast growing cocoa producing country.

Innovation: In October 2020 the Callebaut brand introduced its remastered Finest Belgian Chocolate range, improving taste and optimizing workability. In addition, artisans can now tell their own bean-to-bar story by tracing the 100% sustainable cocoa bean selection back to the cocoa farming communities.

In tune with shifting consumer attitudes towards tasty and nutritious food and drinks that also do good for the planet, Barry Callebaut launched under its new brand Cabosse Naturals in October 2020, a range of 100% pure cacaofruit ingredients: pulp, juice, concentrate and cascara. The ingredients enable brands, artisans and chefs to create delicious cacaofruit experiences in the form of beverages, ice creams, snacks, yogurts, and chocolate confectionery.

In February 2020, Barry Callebaut introduced the 100% dairy-free ‘M_lk Chocolate’. This chocolate satisfies the growing demand for plant-based indulgence and is part of the growing portfolio of ‘Plant Craft’ products ranging from chocolate, nuts and fillings to decorations. Also in February 2020, Mona Lisa, Barry Callebaut’s global decorations brand, launched ‘Mona Lisa 3D Studio’, the world’s first personalized 3D printed chocolate at scale. Hotels, pastry chefs and coffee chains can now excite their customers with previously unseen chocolate experiences.

Cost leadership: In July 2020, Barry Callebaut successfully placed its second Schuldscheindarlehen. The issuance of a CHF 450 million equivalent Schuldscheindarlehen further strengthened the Group’s committed long-term liquidity structure at attractive rates, with a weighted average maturity of 5.4 years, and reduced Barry Callebaut’s reliance on uncommitted short-term funding sources.

Furthermore, Barry Callebaut invested in the fiscal year under review significantly in the simplification and digitalization of its processes and tools. These investments helped to control costs and have been instrumental in maintaining business continuity during the pandemic. The Group also accelerated the centralization of resources at its Shared Service Center in Lodz, Poland, which bundles Finance, IT, Procurement and HR activities.

Sustainability: In October 2020, Barry Callebaut reached an important milestone on its journey towards 100% sustainable chocolate: All global Gourmet brands of Barry Callebaut are now exclusively sourcing 100% sustainable cocoa for their chocolates.

In July 2020, Forever Chocolate was recognized by Sustainalytics as the #2 sustainability strategy, out of 182 assessed companies in the packaged food industry. Sustainalytics is the leading company assessing the industry’s efforts to manage the environmental, social and governance risks in supply chains. For the second straight year, Sustainalytics gave Barry Callebaut a top ranking, showing that the Group is consistently leading among peers.

In September 2020, Barry Callebaut disclosed its direct cocoa suppliers in Côte d’Ivoire, Ghana and Cameroon. By publicly sharing this information, Barry Callebaut is contributing to transparency and traceability in its cocoa supply chain and showcasing the Group’s data collection capabilities and its confidence in the robustness of its data. Also in September 2020, Japanese chocolate manufacturers, artisans and retailers partnered with the Cocoa Horizons Foundation to improve the livelihoods of cocoa farmers and their communities and to drive sustainable indulgence in Japan.

Regional/Segment performance

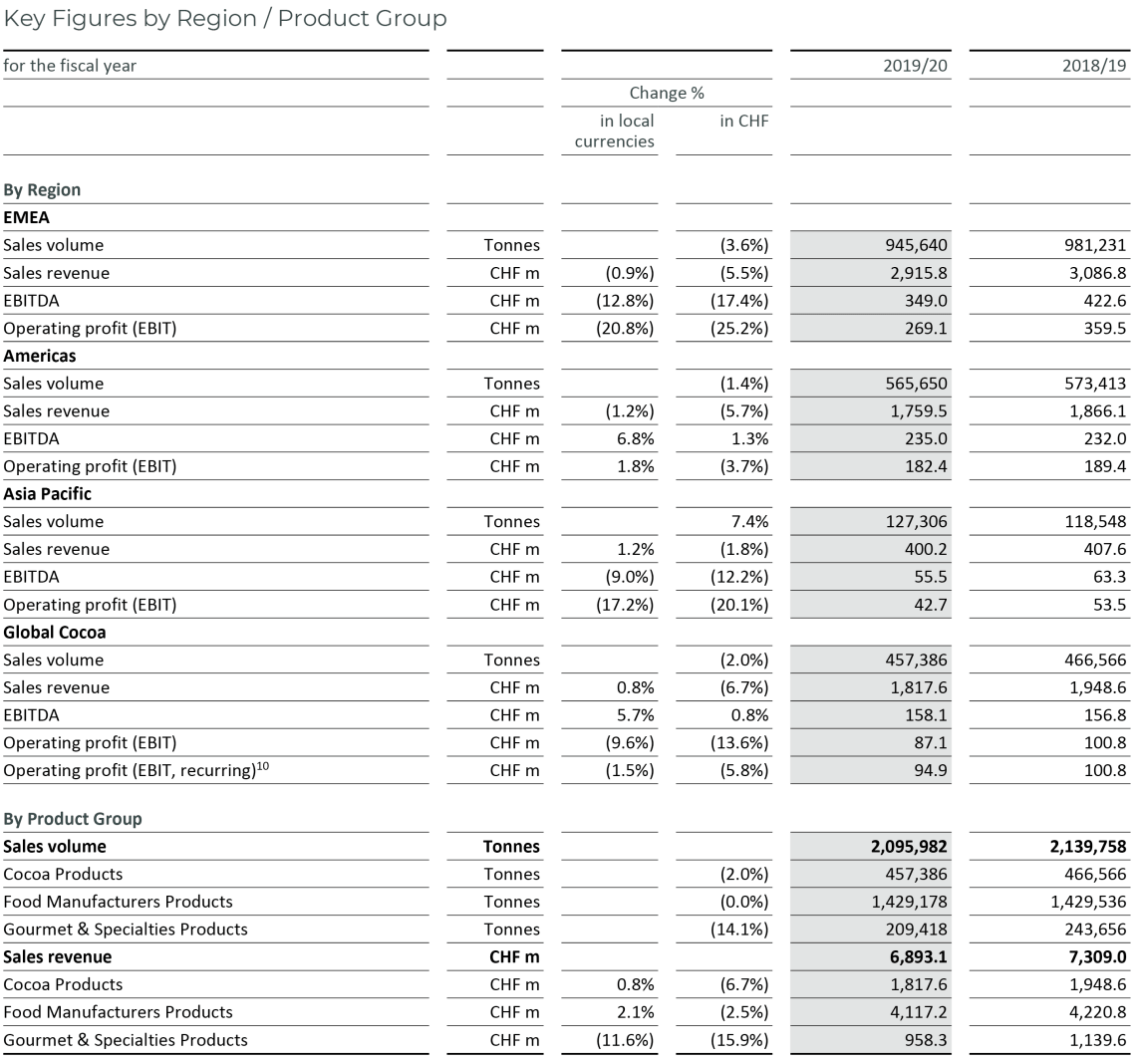

Region EMEA – Steady volume recovery

Sales volume in Region EMEA declined by –3.6%8 to 945,640 tonnes. Excluding the first-time consolidation of Inforum as of February 2019, organic volume declined by –5.2%. As distribution channels were gradually reopening, Gourmet & Specialties began to recover in the fourth quarter, limiting the decline for the fiscal year under review to the high teens, after its volume was nearly halved in the third quarter. Food Manufacturers rapidly recovered in the fourth quarter, leading to a small decline in the low single-digit range for fiscal year 2019/20. Sales revenue in EMEA amounted to CHF 2,915.8 million, a decline of –0.9% in local currencies (–5.5% in CHF). Operating profit (EBIT) amounted to CHF 269.1 million, down –20.8% in local currencies (-25.2% in CHF) due to the adverse mix effect.

Region Americas – Resilient performance

Sales volume in Region Americas declined by –1.4%8 to 565,650 tonnes. The resilient performance was based on a solid volume recovery by Food Manufacturers in the fourth quarter, with customers serving the out-of-home channel still being affected by COVID-19 measures. Gourmet & Specialties’ volume declined in the low teens for the fiscal year under review. Sales revenue in Americas amounted to CHF 1,759.5 million, down –1.2% in local currencies (–5.7% in CHF). Operating profit (EBIT) amounted to CHF 182.4 million, up +1.8% in local currencies (–3.7% in CHF) on the back of robust volume and the resilient product portfolio.

Region Asia Pacific – Good volume growth, adverse mix

Region Asia Pacific grew its sales volume by +7.4%8 to 127,306 tonnes, a good result in light of the COVID-19 pandemic and the high comparison base. Food Manufacturers showed good resilience with double-digit volume growth for the fiscal year under review, supported in particular by large customers. Gourmet & Specialties’ volume continued to recover after the lockdowns, leading to a low single-digit decline for fiscal year 2019/20. Sales revenue amounted to CHF 400.2 million, up +1.2% in local currencies (–1.8% in CHF). Operating profit (EBIT) amounted to CHF 42.7 million, compared to CHF 53.5 million in prior year (–17.2% in local currencies, –20.1% in CHF), which is due to the negative product mix.

Global Cocoa – Solid performance

Sales volume in Global Cocoa declined by –2.0% in the fiscal year under review and amounted to 457,386 tonnes. Sales revenue increased by +0.8% in local currencies (–6.7% in CHF) to CHF 1,817.6 million, due to higher average cocoa bean prices. Operating profit (EBIT) recurring9 decreased by –1.5% in local currencies (–5.8% in CHF) to CHF 94.9 million, in line with volume decline.

Raw material price developments

During fiscal year 2019/20 cocoa bean prices fluctuated between GBP 1,560 and GBP 2,045 per tonne and closed at GBP 1,762 per tonne on August 28, 2020. On average, cocoa bean prices increased by +6.3% versus prior year. Global bean supply and demand were balanced. In July 2019, Côte d’Ivoire and Ghana announced a living income differential (LID) of USD 400 per tonne of cocoa beans, effective as of the 2020/21 crop.

Sugar prices in Europe increased on average +7.6% mainly due to a poor crop and a reduction in capacity induced by low prices in previous years. The world market price for sugar also increased on average by +4.1%.

Dairy prices increased during the fiscal year 2019/20 on average by +21.0% on the back of weak milk supply and strong demand in the first six months of the period under review. Due to COVID-19, demand has slowed down since the third quarter.

8 The underlying chocolate confectionery market growth according to Nielsen does not include e-commerce and only partially reflects the out-of-home and impulse consumption. According to Nielsen, the volume growth for the period September 2019 to August 2020 was: EMEA +1.5%, Americas –2.4%, Asia Pacific –5.3%.

9 Operating profit (EBIT) excluding the cost of CHF –7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

Proposals to the Annual General Meeting (AGM)

Payout to shareholders

The Board of Directors is proposing to shareholders at the Annual General Meeting of Shareholders on December 9, 2020, a payout of CHF 22.00 per share, corresponding to a stable payout ratio of 39%. The dividend will be paid to shareholders on, or around, January 7, 2021, subject to approval by the Annual General Meeting of Shareholders.

Board of Directors

Suja Chandrasekaran, Board member since 2018 and member of the Nomination & Compensation Committee (NCC), will not stand for reelection at the Annual General Meeting of Shareholders on December 9, 2020. The Board of Directors would like to express its sincere gratitude to Suja Chandrasekaran for her valuable contributions to the Board.

All other members of the Board will stand for reelection for another term of office of one year.

The Board of Directors proposes to elect Yen Yen Tan, Singaporean national, as new member of the Board. Yen Yen Tan brings a deep insight into the fast pace innovations in the digital and technological sector. She has built her experience by serving over 30 years in a range of senior level executive positions in multinational companies in the technology and telecom sectors. Her last executive role was President Asia Pacific at Vodafone Group.

Annual General Meeting

Due to the COVID-19 pandemic, the 2019/2020 Annual General Meeting of Shareholders of Barry Callebaut AG cannot take place in the usual format. To protect the health of its shareholders and employees, voting rights can be exercised exclusively electronically or in writing. Details can be found on the Group website and in the invitation to the Annual General Meeting which will be sent by mid-November 2020.

Further information is available in the following publications available as of today:

- Online Annual Report 2019/20

- Annual Report 2019/20 (PDF)

- Short Report 2019/20 English and German

Media and Analyst Conference of the Barry Callebaut Group

| Date: | Wednesday, November 11, 2020 at 10:00–11:00 CET |

Financial Calendar for Fiscal Year 2020/21

(September 1, 2020 to August 31, 2021)

| Annual General Meeting 2019/20 | December 9, 2020 |

| 3-Month Key Sales Figures 2020/21 | January 27, 2021 |

| Half-Year Results 2020/21 | April 22, 2021 |

| 9-Month Key Sales Figures 2020/21 | July 15, 2021 |

| Full-Year Results 2020/21 | November 10, 2021 |

| Annual General Meeting 2020/21 | December 8, 2021 |

Available downloads

Media/Analyst Conference Presentation

Barry Callebaut Group Annual Report 2019/20

Barry Callebaut Group Short Report

About Barry Callebaut Group:

With annual sales of about CHF 6.9 billion (EUR 6.4 billion / USD 7.1 billion) in fiscal year 2019/20, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.