According to Euromonitor1, Bakery and Pastry products in EMEA are worth an astonishing 91 billion Euros, and they're likely to grow at a CAGR of 1.3% by 2025 so there are a lot of opportunities for you to take advantage of.

When looking into the different categories, Cakes/Pastries and Sweet biscuits represent the biggest segments, with 80% of the BaPa market. Snack bars is the fastest-growing segment with a CAGR of 3.4% between 2020-2025.

What drives this growth and dynamism? Find out more in the 6 key consumer trends we spotted in the EMEA Bakery and Pastry market.

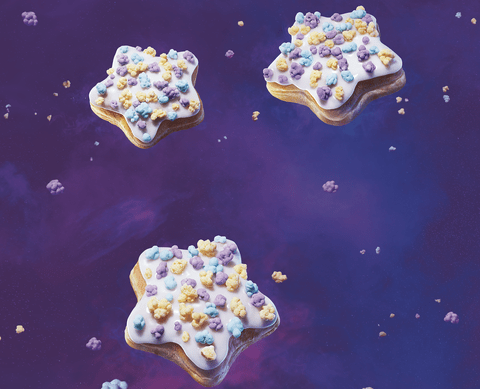

Source: Dunkin’ Donuts, International

Extraordinary Experiences

More than ever, consumers are looking for indulgent experiences: multi-sensorial and surprising. Whether it is a way of escaping the ordinary or seeking comfort or just fancying a celebration moment, baked goods are definitely part of this trend as a food experience. According to Innova2, 48% of European consumers are interested in trying new sensory experiences (aromas, tastes, textures, colors and sensations).

Dunkin Donuts regularly launches new donuts with extraordinary experiences such as the Shooting Star Donut. This galactic sweet treat is decorated with white icing and sprinkled with colorful and flavored popping candy clusters.

Source: Almondy Ruby Passion Cake, Sweden

Eat with your eyes

In today’s social media-driven world, a baked good's instagenic appeal is of paramount importance, and it is a primary factor in the buyers' decision to go for it. Bright or vibrant colors, surprising combination of decorations, visual appeal influences the way taste and flavor are perceived. If you take into account that 57% of European consumers are Instagram users (Foresight Factory3), there is no more need to stress the importance of amazingly appealing creations.

Almondy jumped on this trend train and launched the Ruby Passion Cake, a passion fruit cake baked on an irresistible almond base, combined with passion fruit cream, a wonderful coating with Ruby chocolate and topped with white chocolate and Ruby decorations.

Source: Marks&Spencer, United Kingdom

Celebration

In addition to traditional and, more important, seasonal celebrations, people are now looking for new occasions to celebrate. So they can experience more little moments of joy, throughout the year. If, according to Mintel4, 57% of European consumers say they are more likely to indulge when they are socializing with friends and family, there needs to be a treat answering all precious moments to celebrate.

For a special celebration moment (engagement or even marriage), Marks&Spencer launched a limited edition offer: Love Cocoon Colin & Connie.

Source: Nature Valley™, United Kingdom

Healthy Living

Following a recent McKinsey5 study, 30% of consumers focus more on healthy eating & nutrition in 2021 vs 2020. The bakery market is also addressing consumers’ concerns about health and wellness. Better-for-you treats mostly come with claims: gluten-free, paleo, keto, lactose-free, sugar-reduced and GMO/E-numbers free. They contain less or cleaner ingredients and portion sizes are often adapted to mini bites or smaller sizes.

Nature Valley™ offers a whole range of bars, biscuits and cups that are minimally processed and packed with real ingredients. They combine nuts, nut butter and oats with fruit, honey, chocolate and peanut butter for the ultimate natural tasty snack.

Source: Sainsbury, United Kingdom

Treats for the planet

The next generation of consumers want their indulgences to be as kind to the environment and people as possible, while still being delicious. Plant-based, Organic, Natural, Sustainably Sourced and Traceable are becoming the claims of the future, alongside existing trustful certifications. Today 40% of European consumers are influenced by the environmental impact of their food and drink (Foresight Factory6) and we believe this number will only grow.

Sainsbury’s has unveiled a new own-label plant-based range ahead of Veganuary. As a response to the ‘soaring demand’ for plant-based products in the UK, Sainsbury launched a whole range of plant-based ambient, chilled and frozen lines including fresh meat alternatives like vegan steaks as well as plant-based comfort food lines like cakes and desserts.

Source: La Confiance Biscuits, Belgium

Provenance & Buying Local

Consumers want more transparency around what they eat: Who made it? What were the farming methods? Where do the ingredients come from? What is the story behind the making of my bakery treat? They want to go for real food with a real flavor!

The concept of La Confiance speculoos is a unique example: an old family recipe from 1924 was brought back to life with only the best organic ingredients: real butter and carefully selected spices. The main ingredients are sourced 100% from organic farmers, testifying on the packaging: Belgian, organic wheat from farmer Thibault from Beaumont (Belgium), organic hazelnuts from farmer Federico from Piemonte (Italy) and organic, fair-trade cocoa from farmer José from Peru. 56% of European consumers are keener than in the past to buy locally produced foods. (Foresight Factory3)

6 in 10 French and UK Centennials say they would like more information about where chocolate comes from

Sources:

-

Euromonitor, retail market value, 2021

-

Innova, 2020

-

Foresight Factory, 2021

-

Mintel, 2020

-

McKinsey, 2021

-

Foresight Factory, 2020

-

Barry Callebaut proprietary consumer survey, 2021