9-Month Key Sales Figures

Fiscal Year 2022/23

9-Month Key Sales Figures

Fiscal Year 2022/23

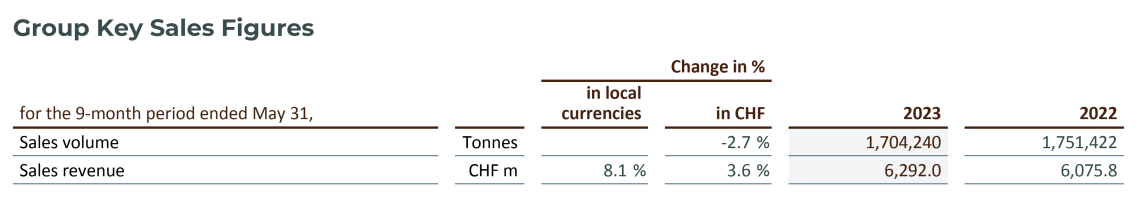

- Sales volume down -2.7% in the first nine months, in a challenging market environment

- Sales revenue of CHF 6.3 billion, up +3.6% in CHF (+8.1% in local currencies)

- Continue to work towards flat volume growth for the Full Year 2022/23 and remain confident to deliver solid operating profit

- Full strategic update will be provided with the Full-Year Results 2022/23 publication on November 1, 2023

In the first nine months of the fiscal year, we witnessed soft volume in a continued inflationary environment which affected customer demand. Our volume was in line with the declining underlying chocolate confectionery market, excluding the residual effects of the Wieze incident. The recently announced renewal of a global strategic partnership with a key customer underpins the sustained trend toward outsourcing. It is a showcase for the added value we can deliver to customers globally and for the deep relationships our teams are building every day.

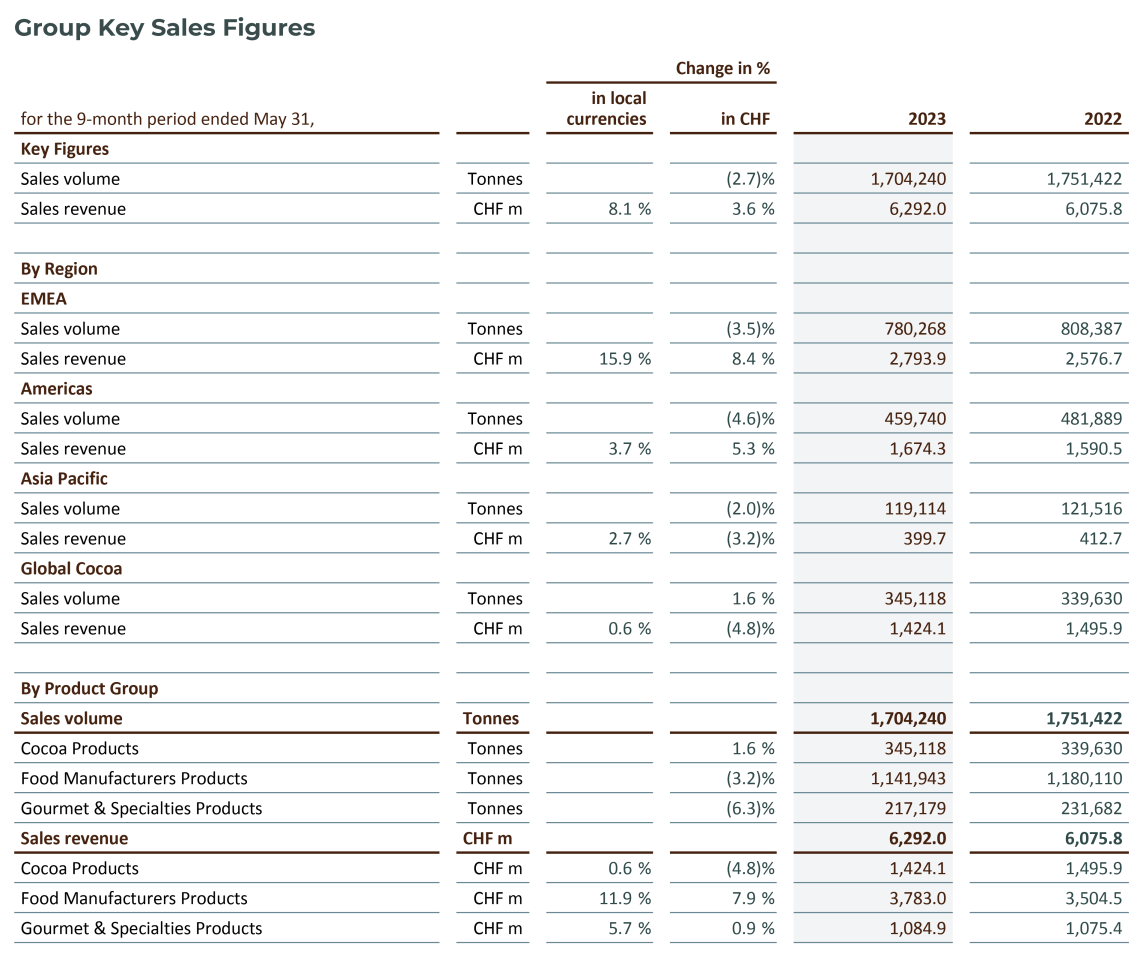

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, reported sales volume of 1,704,240 tonnes, down -2.7%, during the first nine months of fiscal year 2022/23 (ended May 31, 2023). The chocolate volume declined by -3.7% in the period under review, against a high comparison base and including the residual effects from the Wieze incident. Compared to the Half Year, volume decline has stabilized in Regions EMEA (-3.5%) and Americas (-4.6%). In Region Asia Pacific (-2.0%) the inflationary environment had a continued negative effect. Excluding the Wieze ramp-up effect, volume performance was in line with the underlying global chocolate confectionery market (-1.5%)1. Among the Group’s key growth drivers, Emerging Markets maintained its positive volume momentum in the third quarter (+1.9%, 9M +0.0%). Against a high comparator, Gourmet & Specialties volume continued to decline in a challenging market environment (-6.3%), and Outsourcing volume flattened (+0.7%). Sales volume in Global Cocoa grew by +1.6% to 345,118 tonnes.

Sales revenue amounted to CHF 6,292 million, up +3.6% in CHF (+8.1% in local currencies).

Outlook – Continue to work towards flat volume growth for the Full Year 2022/23

Looking ahead, CEO Peter Feld said:

In a challenging market environment, we continue to work towards flat volume growth for the Full Year 2022/23 and remain confident to deliver solid operating profit. We will provide a full strategic update with the Full-Year results publication on November 1, 2023.

1 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2022 to April/May 2023, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

Strategic milestones

Expansion: In June 2023, Unilever, a global market leader in ice cream, extended its long-term global strategic agreement for the supply of cocoa and chocolate from Barry Callebaut. The renewed agreement, originally signed in 2012, foresees intensified collaboration in the areas of innovation and sustainability. Barry Callebaut will focus on delivering the latest chocolate innovations for ice cream to Unilever and as a result drive strategic, long-term growth globally.

Innovation: In May 2023, Barry Callebaut launched in the Mexican Gourmet market Callebaut NXT, a dairy-free delight made with 100% plant-based ingredients, and SICAO Zero, a sugar-free chocolate. With the launches, Barry Callebaut is responding to the growing demand for "mindful indulgence" by offering healthier chocolate alternatives without compromising taste.

Cost Leadership: In May 2023, Barry Callebaut held a groundbreaking ceremony for its new cocoa bean warehousing and dispatching facility in Pasir Gudang, Malaysia. The facility, which spans across more than half a million square feet, will increase operational efficiency and support Barry Callebaut's growth plans in the Region.

On June 15, 2023, the USD 400 million senior bond was fully repaid at maturity. Thanks to the Group's strong structural cash generation, no new fundraising was needed, hereby further reducing the gross debt of the Group.

Sustainability: In May 2023, Barry Callebaut added fresh ambition to its Forever Chocolate plan, building on the insights gained during the past six years. By setting additional measurable targets for 2030 and beyond, the Group is committed to driving long-term systemic change for a sustainable cocoa supply chain.

Regional/Segment performance

Region EMEA

In Region EMEA (Europe, Middle East and Africa) sales volume amounted to 780,268 tonnes, down -3.5% in the first nine months of fiscal year 2022/23, in a declining underlying chocolate confectionery market (-2.7%)2. Food Manufacturers volume decline stabilized with positive growth in South Eastern Europe, driven by outsourcing contracts. Gourmet & Specialties volume decline remained in the mid-single digits in the period under review. Sales revenue amounted to CHF2,794 million, up +8.4% in CHF (+15.9% in local currencies).

Region Americas

In Region Americas sales volume amounted to 459,740 tonnes, down -4.6% in the first nine months of fiscal year 2022/23, in an overall weak chocolate confectionery market (-0.9%)2. Food Manufacturers volume continued to decline in the third quarter due to pressure from inflation, in particular in key markets like Mexico. Gourmet & Specialties volume growth in North America reflected further weakness from local brands, but volume growth remained positive in Latin America. Sales revenue amounted to CHF 1,674 million, up +5.3% in CHF (+3.7% in local currencies).

Region Asia Pacific

In Region Asia Pacific sales volume amounted to 119,114 tonnes, down -2.0% in the first nine months of fiscal year 2022/23. The underlying chocolate confectionery market grew by +2.7%2 according to Nielsen. Weaker volume in the third quarter was mainly attributable to Food Manufacturers, which continued to suffer from the inflationary impact on volume. Gourmet & Specialties volume growth was slightly positive in the third quarter, supported by strong local brands in key markets like India and Indonesia. Sales revenue amounted to CHF 400 million, down -3.2% in CHF (+2.7% in local currencies).

Global Cocoa

Sales volume growth in Global Cocoa continued its positive momentum, leading to an increase of +1.6% to 345,118 tonnes in the first nine months of fiscal year 2022/23. Sales revenue amounted to CHF 1,424 million, down -4.8% in CHF (+0.6% in local currencies).

Price developments of key raw materials

During the first nine months of fiscal year 2022/23, terminal market3 prices for cocoa beans fluctuated between GBP 1,822 and GBP 2,341 per tonne and closed at GBP 2,036 per tonne on May 31, 2023. On average, cocoa bean prices increased by +15.5% versus the prior-year period. The global bean supply and demand forecast for 2022/23 indicates a deficit.

Sugar prices in Europe increased on average by +63.1% during the period under review, due to low stocks, a poor crop and high energy prices. The world market price for sugar increased on average by +10.9% on the back of lower exports from India and a slow start of the crop in Brazil.

Dairy prices decreased on average by -19.5% during the first nine months of fiscal year 2022/23, driven by a combination of supply and demand factors. While global milk supply improved, consumer demand slowed due to the persistent high inflation.

2 Source: Nielsen. The volume growth - excluding e-commerce - for the period September 2022 to April/May 2023. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

3 Source: London terminal market prices for 2nd position, September 2022 to May 2023. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Downloads

Financial Calendar for Fiscal Year 2022/23

(September 1, 2022 to August 31, 2023):

| Full-Year Results 2022/23 | November 1, 2023 |

| Annual General Meeting 2022/23 | December 6, 2023 |

About Barry Callebaut Group:

With annual sales of about CHF 8.1 billion in fiscal year 2021/22, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 65 production facilities worldwide and employs a diverse and dedicated global workforce of more than 13,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Follow the Barry Callebaut Group: