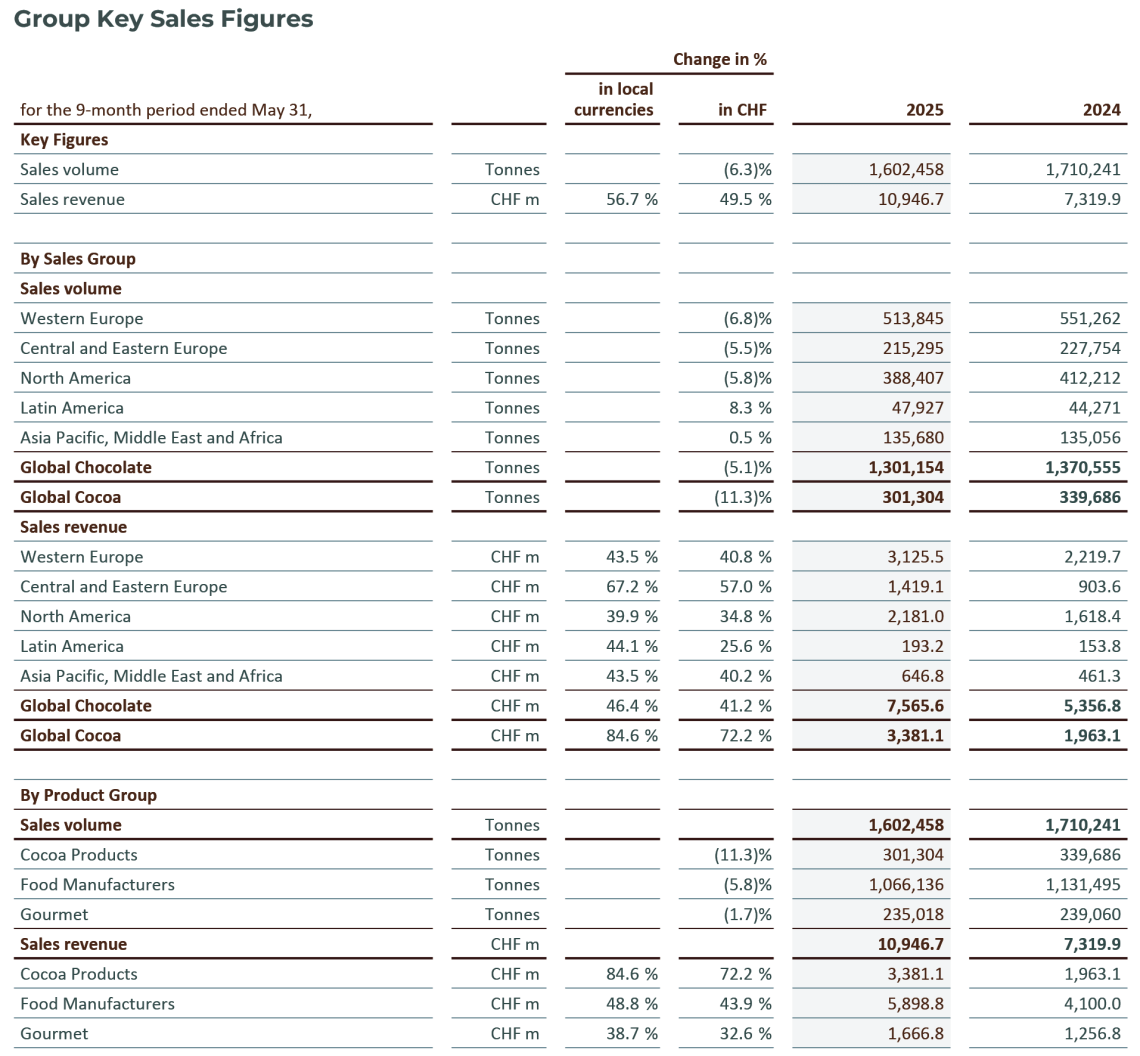

Global Chocolate saw a -5.1% volume decrease in an overall declining chocolate confectionery market according to Nielsen (-3.0%)2. The market saw its largest decline in a decade in the third quarter (-4.2%)3, with Global Chocolate volumes decreasing by -6.2%. Volume development for Food Manufacturers (-5.8%) remained impacted by market volatility and customer behavior changes. Volumes in Gourmet also decreased (-1.7%) but the channel was more resilient, with strong growth in AMEA and Latin America. In the third quarter, the Gourmet business saw -6.4% volume with quarterly volatility driven by the phasing of customer purchases.

Looking at regional performance within Global Chocolate, Latin America (+8.3%) was the strongest contributor to volume performance, supported by innovative customer solutions. Asia Pacific, Middle East and Africa (AMEA) saw positive growth (+0.5%) with negative growth in the third quarter (-2.2%), as strong growth in India, the Middle East and Indonesia was offset by negative growth in China and the South Pacific. Volumes declined in Central and Eastern Europe (-5.5%) driven by a challenging customer environment especially in Türkiye. North America reported a volume decrease of -5.8%. New customer wins were more than offset by the challenging demand environment, customer ramp up in Toluca, Mexico and additional tariff-related uncertainty, resulting in -12.3% volume in the third quarter. Volume development in Western Europe (-6.8%) was significantly impacted by customers adapting to higher and volatile cocoa bean prices, as well as by SKU rationalization.

Global Cocoa saw an -11.3% decrease in sales volume, with a -22.6% decline in the third quarter. The business saw a negative market demand impact from significant cocoa bean price increases, particularly in AMEA, CEE and Latin America. Volumes were also impacted by prioritization of volume towards higher return segments within Cocoa and to Global Chocolate in a supply constrained environment.

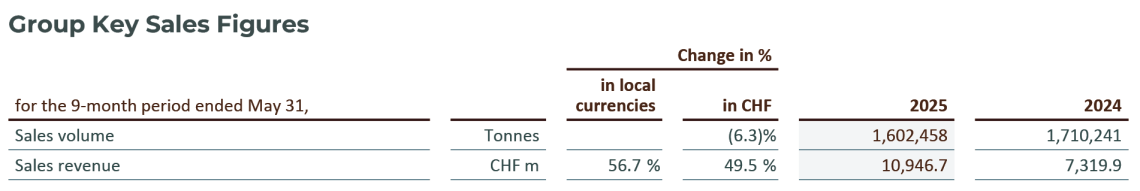

Overall, the Barry Callebaut Group reported sales volume of 1,602,458 tonnes, down -6.3%, for the first nine months of the fiscal year 2024/25 (ended on May 31, 2025). Sales volume decreased -9.5% in the third quarter, as the highly volatile market environment impacted customer behavior, with particular tariff-related uncertainty in North America, as well as the impact of prioritization in the Global Cocoa business.

Sales revenue amounted to CHF 10,946.7 million, an increase of +56.7% in local currencies (+49.5% in CHF). Growth was driven by the successful pass through of significantly higher cocoa prices, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

2 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2024 - April/May 2025. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

3 Source: Nielsen volume growth excluding e-commerce – 26 countries, February 2025 - April/May 2025. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.