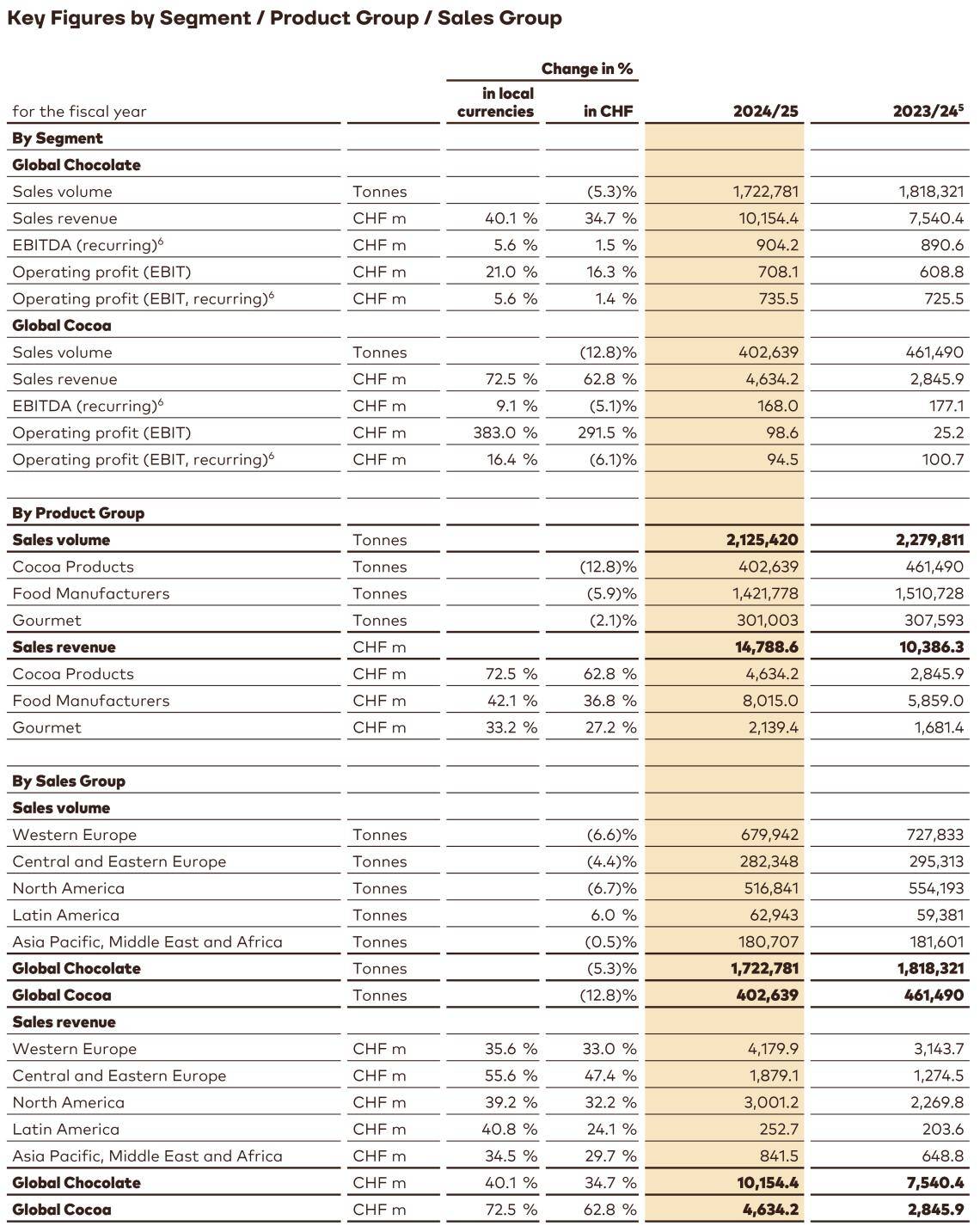

Global Chocolate saw a -5.3% volume decrease in fiscal year 2024/25, in an overall challenging and declining chocolate confectionery market according to Nielsen (-3.5%)3. Volume development for Food Manufacturers (-5.9%) was impacted by customer behavior shifts in the context of volatility and significantly higher prices. Gourmet was more resilient (-2.1%), as a challenging environment in Western Europe and North America was partly offset by growth in AMEA, Latin America and CEE.

Looking at regional performance within Global Chocolate, Latin America (+6.0%) was the strongest contributor, driven by innovative customer solutions across business segments and clusters. Asia Pacific, Middle East and Africa (AMEA) saw slightly negative growth (-0.5%) as demand pressures in China and developed markets offset double-digit growth in India, Indonesia and the Middle East. Central and Eastern Europe (CEE, -4.4%) was impacted by a challenging customer environment, particularly for local Food Manufacturers. North America reported a volume decrease of -6.7%, as new customer wins were offset by the challenging market environment and the residual impact of the Toluca, Mexico intervention. Volume in Western Europe (-6.6%) was significantly impacted as higher prices resulted in demand softness and influenced customer behavior, as well as by SKU rationalization.

Global Cocoa saw a -12.8% decrease in sales volume. The business was impacted by negative market demand given major cocoa bean price volatility, particularly in AMEA, CEE and Latin America. Volumes were also impacted by the prioritization of volume towards higher return segments within Global Cocoa and towards Global Chocolate given the high price environment.

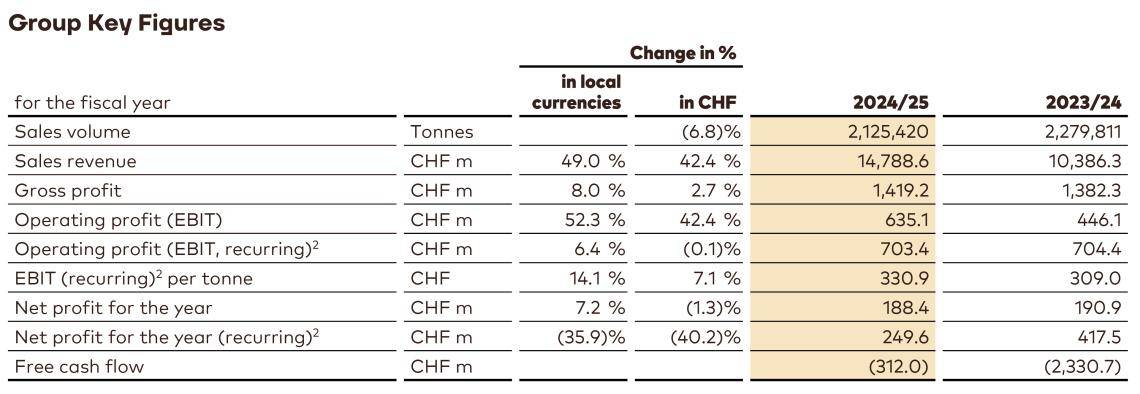

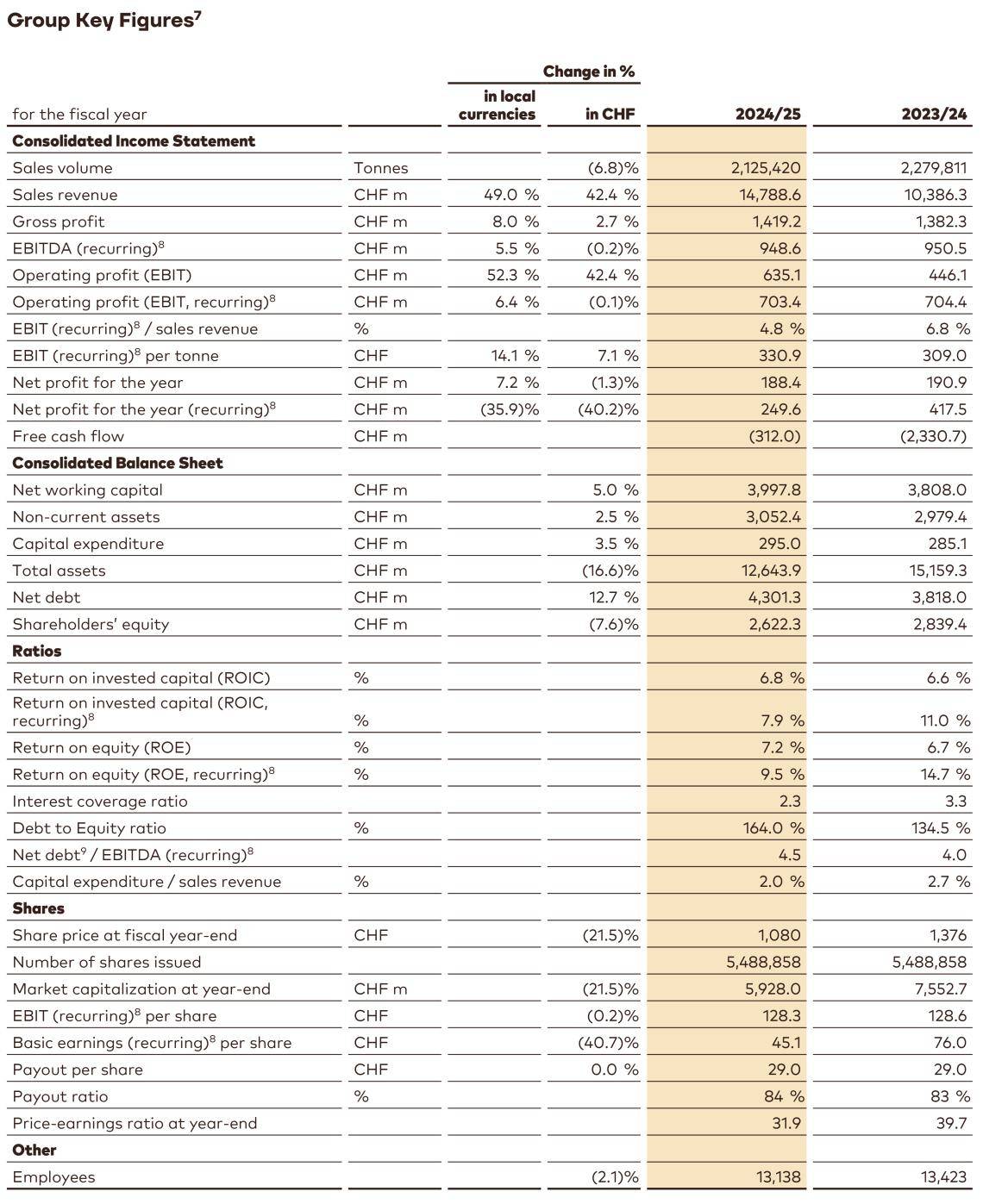

Overall, the Barry Callebaut Group delivered sales volume of 2,125,420 tonnes (-6.8%) in fiscal year 2024/25. Sales volume was down -8.2% in the fourth quarter, impacted by demand softness, customer behavior changes in the volatile environment as well as by return prioritization in the Global Cocoa business.

Sales revenue increased +49.0% in local currencies (+42.4% in CHF), to CHF 14,788.6 million. The increase was driven by significant price increases to reflect higher cocoa bean prices, which Barry Callebaut manages through its cost-plus pricing model.

Gross profit amounted to CHF 1,419.2 million, up +8.0% in local currencies (+2.7% in CHF), supported by the company's cost-plus pricing model and mix.

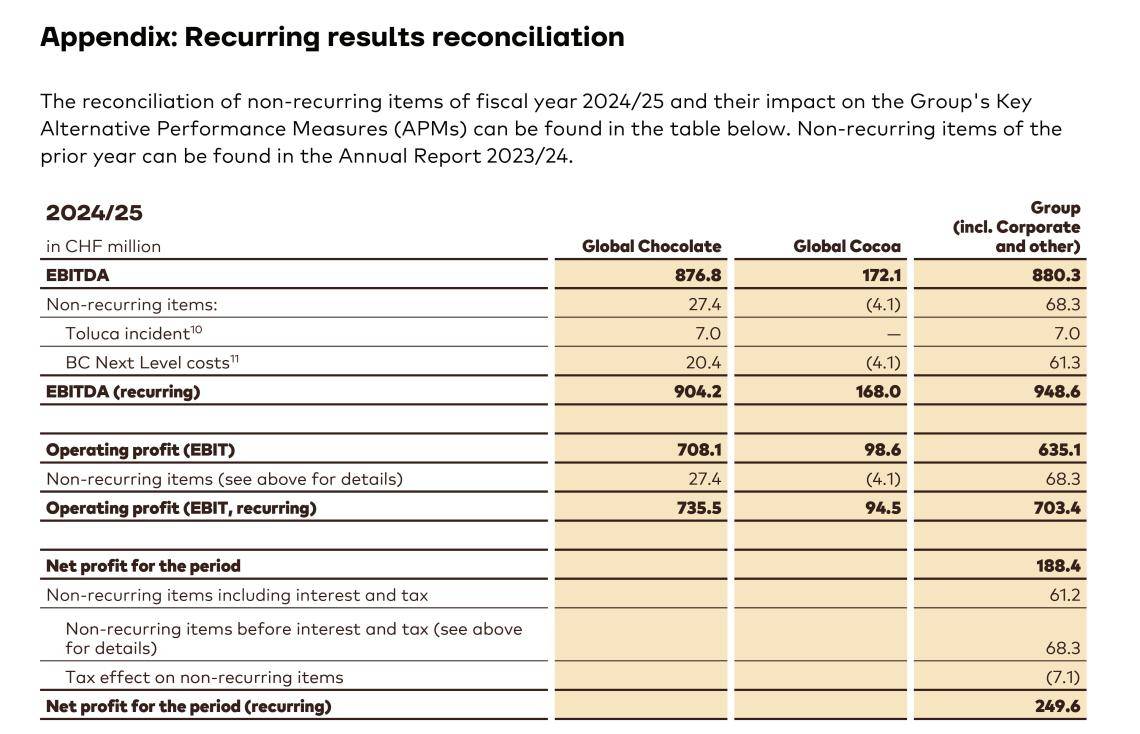

Operating profit (EBIT) recurring4amounted to CHF 703.4 million, increasing by +6.4% in local currencies (-0.1% in CHF). The increase was supported by the pricing of higher financing costs through the cost-plus model, mix and BC Next Level cost savings, which more than offset the impact of negative volume growth and investments behind digital and capabilities in the new market reality. EBIT recurring4 per tonne amounted to CHF 331, up +14.1% in local currencies (+7.1% in CHF). EBIT recurring4 for Global Chocolate was CHF 735.5 million, up +5.6% in local currencies (+1.4% in CHF), similarly reflecting the strength of the Group's cost-plus model. EBIT recurring4 for Global Cocoa was CHF 94.5 million, up +16.4% in local currencies (-6.1% in CHF). The strong increase was supported by passing through of higher financing costs and volume prioritization on higher return segments. Corporate and other saw EBIT recurring4 of CHF -126.6 million, down -9.9% in local currencies (-3.9% in CHF).

Following a highly volatile market which caused a significant decrease in the first half of the year, net profit recurring4 in local currencies was flat in the second half of the fiscal year (-0.1%) as market volatility stabilized and as the Group took action to further pass-through higher costs. For the full-year, net profit recurring4 amounted to CHF 249.6 million, down -35.9% in local currencies (-40.2% in CHF). Performance was impacted by lower volumes and higher costs in a disrupted market. Net finance costs increased significantly to CHF -376.9 million, up from CHF -207.3 million in the prior year, mostly as a result of the higher debt level in the context of the cocoa bean price acceleration as well as increased interest rates. On a recurring4 basis, income tax expense increased to CHF 76.9 million from CHF 74.8 million in the prior-year period. This corresponds to an effective tax rate of 23.6% (prior-year period: 15.2%). The increase in effective tax rate on a recurring basis mainly resulted from a less favorable mix of profit before taxes and non-tax-effective losses, partly compensated for the positive effect related to the Swiss Tax Reform that was introduced on January 1, 2020.

Operating profit (EBIT) reported amounted to CHF 635.1 million compared to CHF 446.1 million in the prior year, as a result of lower one-off BC Next Level operating expenses of CHF 61.3 million (vs. CHF 264.5 million in the prior year). Within one-off items, CHF 63.7 million represent cash relevant non-recurring BC Next Level program and restructuring costs.

Net profit reported amounted to CHF 188.4 million, including net one-off BC Next Level program expenses.

Net working capital increased to CHF 3,997.8 million, compared to CHF 3,808.0 million in the prior year. The increase was entirely due to the substantial negative impact from higher cocoa bean prices, largely offset by operational actions to enhance resilience, including cash cycle reduction and sourcing optimization.

The second half of the fiscal year saw a return to a strong free cash flow of CHF 1,802 million supported by working capital actions and lower cocoa bean prices. For the full-year, free cash flow declined to CHF -312.0 million, compared to CHF -2,330.7 million in the prior year. The significant increase in higher cocoa prices and higher investment more than offset operational actions to reduce the cash cycle.

Net debt increased to CHF 4,301.3 million from CHF 3,818.0 million in the prior-year period. The increase is predominantly due to the impact from higher cocoa bean prices during the fiscal year requiring higher financing. The strong working capital actions taken and lower cocoa bean prices in the second half of the fiscal year enabled important progress on deleverage, resulting in a Net debt / EBITDA4 of 4.5x compared to 6.5x in February 2025. When taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), adjusted Net debt / EBITDA4 was 2.7x.

3 Source: Nielsen volume growth excluding e-commerce – 24 countries, September 2024 - August 2025. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

4 Refer to appendix on page 9 (of the PDF) for the detailed recurring results reconciliation.