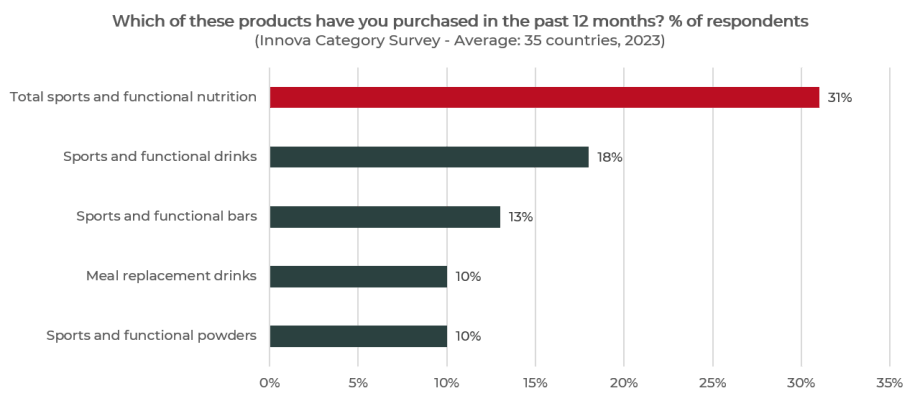

31% of global consumers consume sports and functional nutrition products (3)

Sports nutrition is no longer for athletes only

Following the sales decline in 2020 against a backdrop of gym closures and lockdowns due to the pandemic, a recovery for Sport Nutrition was seen in 2021 as vaccination programmes rolled out across Western Europe, with stronger growth then being recorded in 2022 as society was finally returning to normality.

A dynamic performance is expected over the forecast period, with most areas of sports nutrition, and particularly sports protein powder, recording stronger CAGRs in 2022-2027 than over the historic period.1

According to a survey by Foresight Factory, two-thirds (67%) of global consumers play sports or exercise at least once a week. Weekly participation rates are highest in China (83%) and Brazil (79%), while Millennials lead among the generations.2

Over half (52%) of global consumers say they exercise/play sports to improve their physical health. Instead 37% said they do sports to improve their mental health. Other drivers are: losing weight (for 29% of global consumers), and improve their physical appearance (for 28%).2 Therefore, there is a huge opportunity lying for those engaging occasionally in running, cycling, or other leisure sports activities.

It’s interesting that nearly 1 in 3 consumers globally consume sports and functional nutrition products, with those in Vietnam, South Africa, Indonesia and the US most likely to do so. The most desirable function for consumers globally (with 32% choosing this function) is boosting or sustaining energy, while 26% chose boosting immunity, hydrating or improving gut/digestive health.3

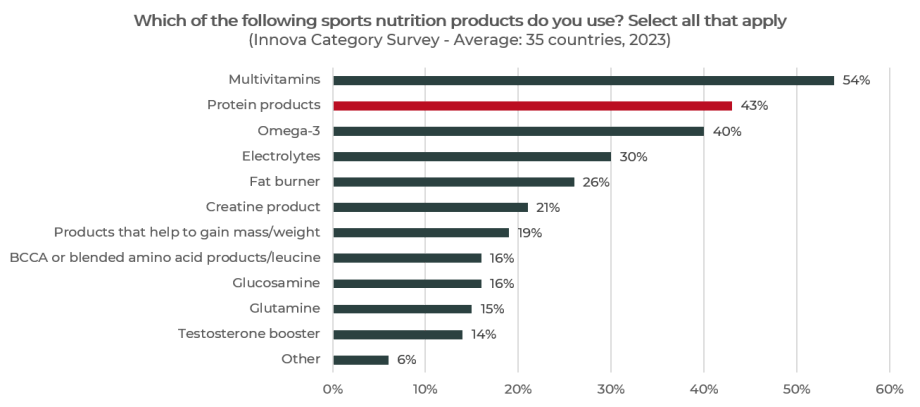

Multivitamins and protein products are the sports nutrition products that global consumers use mostly (3)

What benefits are consumers looking for?

In essence, consumers are looking for products that are good for their bodies. They have a growing knowledge of their specific needs and are more nutritionally aware than before.

They look for products that meet those very specific needs. A high-protein claim is one of the key attributes consumers look for in sports nutrition. Indeed, this nutrient, present for years in the sports world, is linked with energy and a boost of performance, for a workout but also for an active lifestyle.

Make the ingredient list simple so that consumers understand the ingredients and the benefits they bring. And connect with the active consumers by having products that fit their lifestyles (on the go), their activities (yoga, jogging), their food diets (flexitarian, vegan, dairy-free).

Discover 7 key growth drivers in the sports nutrition area

- Indulgence is taking everything by storm: taste is still the purchase driver number one. Play with exciting flavors and textures to impress the consumers and make them want to have more.

- Clean label and premium quality ingredients: consumers want to be reassured on the naturalness of the product and on its efficiency. Back-up the claims that you make and use natural ingredients as much as possible.

- Convenience: with their busy lifestyles, consumers are looking for formats that fit every occasion: think about food and drinks, breakfast solution, pre or post-workout...

- Vegan: use plant-based proteins (pea, rice) which are growing at high speed to cater to the growing vegan trend that is ongoing in all food and non-food sectors.

- Sugar is still the enemy: while consumers see proteins as a good macronutrient, they monitor their sugar consumption so propose low carb or no added sugar options to reassure them.

- Personalization: every consumer is unique and has unique needs. With specific ingredients like vitamins, minerals, probiotics, you can fulfill them and answer their very needs.

- Focus and mental energy: enriched nutrition doesn’t only need to cater to physical wellbeing. Many consumers are looking for a mental boost, whereas it’s for a challenging task at work, an e-sports game, or just an afternoon mood lift.