Full-Year Results Fiscal Year 2018/19

of the Barry Callebaut Group

Full-Year Results Fiscal Year 2018/19

of the Barry Callebaut Group

-

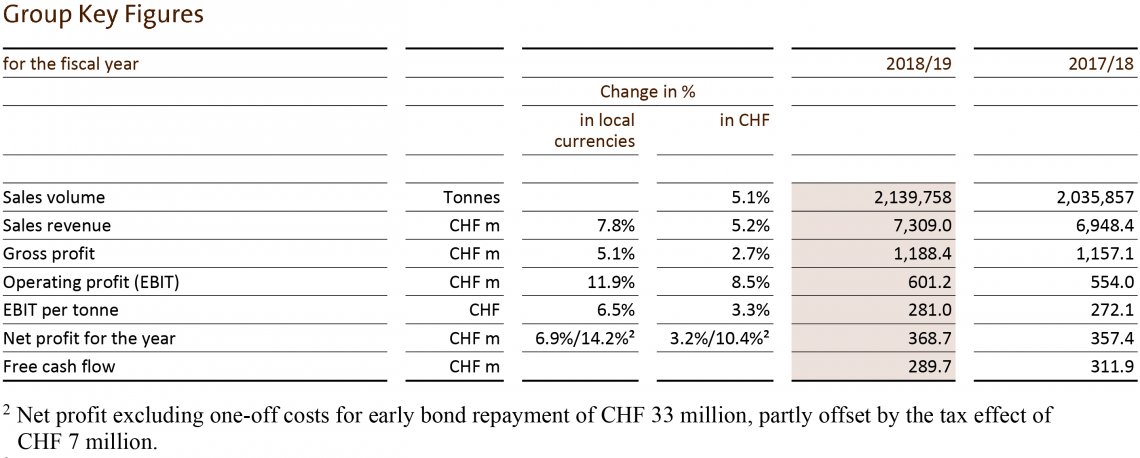

Sales volume up +5.1%, well above the market growth1

-

Sales revenue of CHF 7.3 billion, up +7.8 % in local currencies ( +5.2% in CHF)

-

Operating profit (EBIT) up +11.9% in local currencies ( +8.5% in CHF)

-

Net profit2 up +14.2% in local currencies (+ 10.4 % in CHF)

-

Free cash flow of CHF 290 million

-

Mid-term guidance 2015/16 – 2018/19 delivered3, on average +4.5% volume growth and +13.9% EBIT growth in local currencies

-

Board members Jakob Baer and Juergen Steinemann will not stand for reelection

-

Proposed payout to shareholders of CHF 26.00 per share, up +8.3%

1 Source: Nielsen, +1.8% in volume, August 2018 to August 2019 – 25 countries, excluding e-commerce channels.

2 Net profit excluding one-off costs for early bond repayment of CHF 33 million, partly offset by the tax effect of CHF 7 million.

3 On average for the 4-year period 2015/16 to 2018/19: 4-6% volume growth and EBIT above volume growth in local currencies, barring any major unforeseen events.

I am delighted to announce another set of strong results, with profitable growth and good cash generation. We are also proud to have successfully delivered on our mid-term guidance, which was on average 4-6% volume growth and EBIT above volume growth in local currencies for the 4-year period 2015/16 to 2018/19. On average, we have achieved above-market volume growth of +4.5% and EBIT growth in local currencies of +13.9% per year. These achievements confirm the strength of our long-term ‘smart growth’ strategy.

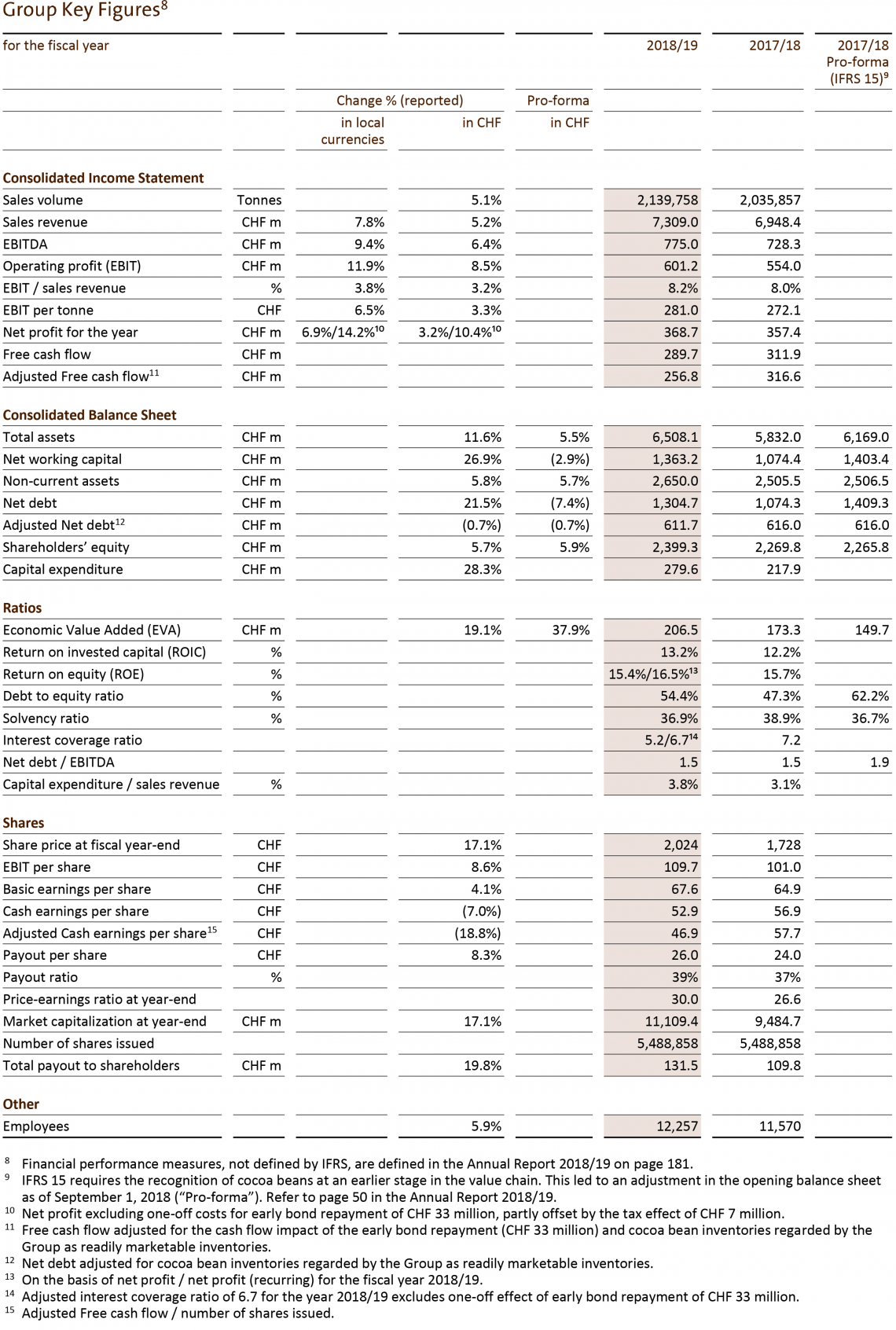

In fiscal year 2018/19 (ended August 31, 2019) the Barry Callebaut Group – the world’s leading manufacturer of high-quality chocolate and cocoa products – increased its sales volume by +5.1% to 2,139,758 tonnes, with, as expected, a stronger contribution in the second half of the year. Sales volume in the chocolate business grew by +5.9%, well above the growth rate of the global chocolate confectionery market (+1.8%)1. All Regions and key growth drivers: Outsourcing (+5.2%), Emerging Markets (+9.7%) and Gourmet & Specialties (excluding Beverage, +6.1%), contributed to the good momentum. Global Cocoa volumes increased by +2.4%.

Sales revenue increased by +7.8% in local currencies (+5.2% in CHF) to CHF 7,309.0 million. The increase in sales revenues was supported by the first-time adoption of IFRS 154 and higher raw material prices, which the Group passes on to its customers for a large part of its business, based on its ‘cost-plus’ model.

Gross profit developed in line with the growth in sales volume and amounted to CHF 1,188.4 million, up +5.1% in local currencies (+2.7% in CHF). The positive effect from volume growth and product mix was offset by costs for structural improvements of operations.

Operating profit (EBIT) increased by +11.9% in local currencies (+8.5% in CHF) to CHF 601.2 million, affected by a strong headwind from currencies (CHF -19 million). EBIT growth was more than double the volume growth, supported by all Regions and Product Groups. The Group’s EBIT per tonne continued to improve to CHF 281, an increase of +6.5% in local currencies (+3.3% in CHF).

Net profit for the year – excluding the one-off effect for the early bond repayment – grew by +14.2%5 in local currencies (+10.4%5 in CHF) to CHF 394.7 million. Reported net profit amounted to CHF 368.7 million, up +6.9% in local currencies (+3.2% in CHF). The net finance expense of CHF 148.4 million were impacted by the one-off costs of CHF 33.0 million for the early repayment of the EUR 250 million Senior Note. In addition, the higher average net debt related to the first-time adoption of IFRS 156 also contributed to the increase in net finance expense. Income tax expenses amounted to CHF 84.0 million in 2018/19, with an effective tax rate of 18.6%.

Net working capital decreased to CHF 1,363.2 million, compared to CHF 1,403.4 million in prior year pro forma IFRS 156, due to good working capital management.

Free cash flow amounted to CHF 289.7 million compared to CHF 311.9 million in prior year and was impacted by the one-off effect of CHF 33.0 million for the early bond repayment. Adjusted for the early bond repayment and for the cocoa beans considered as readily marketable inventories (RMI), the adjusted Free cash flow amounted to CHF 256.8 million compared to CHF 316.6 million in prior year.

Net debt decreased to CHF 1,304.7 million compared to CHF 1,409.3 million in prior year pro forma IFRS 156. Taking into consideration the cocoa beans inventories as readily marketable inventories (RMI), adjusted net debt amounted to CHF 611.7 million compared to CHF 616.0 million in prior year pro forma IFRS 156.

4For details on transition please refer to the Annual Report 2018/19, page 50.

5Net profit excluding one-off costs for early bond repayment of CHF 33 million, partly offset by the tax effect of CHF 7 million.

6IFRS 15 requires the recognition of cocoa beans at an earlier stage in the value chain. This led to an adjustment in the opening balance sheet as of September 1, 2018 (“Pro-forma”). Refer to page 50 in the Annual Report 2018/19.

Outlook - Confident to deliver on renewed mid-term guidance

Looking ahead, CEO Antoine de Saint-Affrique said:

Going forward, we remain committed to pursuing our successful ‘smart growth’ strategy. Good growth momentum, a strong innovation portfolio and discipline in execution make us confident of delivering on our renewed mid-term guidance. This is 4-6% volume growth and EBIT above volume growth in local currencies on average for the 3-year period 2019/20 to 2021/22, barring any major unforeseen events, which is consistent with our prior mid-term guidance.

Strategic milestones achieved in fiscal year 2018/19

“Expansion”: Barry Callebaut expanded in the fiscal year under review across all Regions. In Region Europe, Middle East, Africa (EMEA), the integration of Inforum, a leading Russian B2B producer of chocolate, compound coatings and fillings, acquired in January 2019, is well on track. In April 2019, Barry Callebaut signed a Memorandum of Understanding with the Government of Serbia to build the Group’s first chocolate factory in Southeastern Europe. The plant in Novi Sad is expected to be operational by 2021 and will serve as a regional hub, driving further growth in the Southeastern European market. In August 2019, Barry Callebaut opened its CHOCOLATE ACADEMY™ Center in Antwerp, the 23rd globally. In the same month, Barry Callebaut announced the construction of its new Global Distribution Center in Lokeren, Belgium, to further improve its customer service. The logistics hub is expected to be operational by 2021 and will further drive efficiency. The Group also deepened its presence in Region Asia Pacific, e.g. by opening a CHOCOLATE ACADEMY™ Center in Beijing, China, and by laying the first stone for the construction of a new chocolate and compound manufacturing facility in Baramati, India, one of the fastest growing chocolate markets in Asia. Barry Callebaut also strengthened its partnership with Garudafood, one of the largest food and beverage companies in Indonesia, by opening in August 2019 its second chocolate manufacturing plant in Rancaekek. To keep serving its customers optimally, the Group accelerated the expansion of its chocolate production capacities in the Region Americas. In March 2019, Barry Callebaut inaugurated a new cocoa processing unit in Abidjan, Côte d’Ivoire, which will expand the Group’s capacity in the country by +40% by 2022.

“Innovation”: In May 2019, Ruby, the fourth type of chocolate, was officially introduced in the United States, the world’s largest chocolate and confectionery market, and Canada. Ruby is now available in more than 50 countries worldwide. Barry Callebaut also extended its dairy-free chocolate product portfolio in the United States, tapping into growing customer demand for dairy-free chocolate. Furthermore, Barry Callebaut’s sugar reduced solutions, like the new dark and milk chocolate with only 1% added sugar, cater to the desires of wholesome choice consumers and continued to grow by double-digits. In August 2019, Bensdorp, the premium cocoa brand of Barry Callebaut, introduced “Natural Dark”. It enables food manufacturers to deliver dark cocoa creations with an intense chocolate taste and a 100% clean label. Innovation momentum continued in September 2019, when “Cacaofruit Experience”, a new Food & Drink category including ‘Wholefruit Chocolate’, was officially introduced in San Francisco.

“Cost leadership”: In February 2019, Barry Callebaut successfully placed a EUR 600 million equivalent Schuldscheindarlehen. This transaction improves Barry Callebaut’s debt and liquidity structure by extending the average maturity and diversifying its sources of financing. At least two-thirds of the proceeds will finance sustainability-related projects to support cocoa farmers and their communities. Given the success of its debut in the Schuldscheindarlehen market, the Group repaid in August 2019 its outstanding 5.375% Senior Note, due 2021, in the amount of EUR 250 million. This led to one-off finance costs of CHF 33.0 million in 2018/19, but is expected to have a positive impact of around CHF 10 million on net finance expense as from fiscal year 2019/20. The ongoing roll-out of its SAP system, more efficient business processes as well as digital solutions will continue to contribute to the Group’s cost competitiveness.

“Sustainability”: In order to support the Group’s goals to have more than 500,000 cocoa farmers in its supply chain lifted out of poverty and to become carbon and forest positive by 2025, Barry Callebaut joined two initiatives at the United Nations Climate Action Summit in New York in September 2019. Barry Callebaut co-signed the One Planet Business for Biodiversity (OP2B) coalition, a coalition of food and agriculture companies determined to protect and restore cultivated and natural biodiversity within their value chains. The Group also signed the vision statement for the "Just Rural Transition" initiative. This platform is committed to transforming by 2030 the way in which food is produced and consumed. The company’s investments in sustainable value chains were acknowledged in July 2019, when Sustainalytics ranked Forever Chocolate as the #1 sustainability strategy out of 178 food companies.

Regional/Segment performance

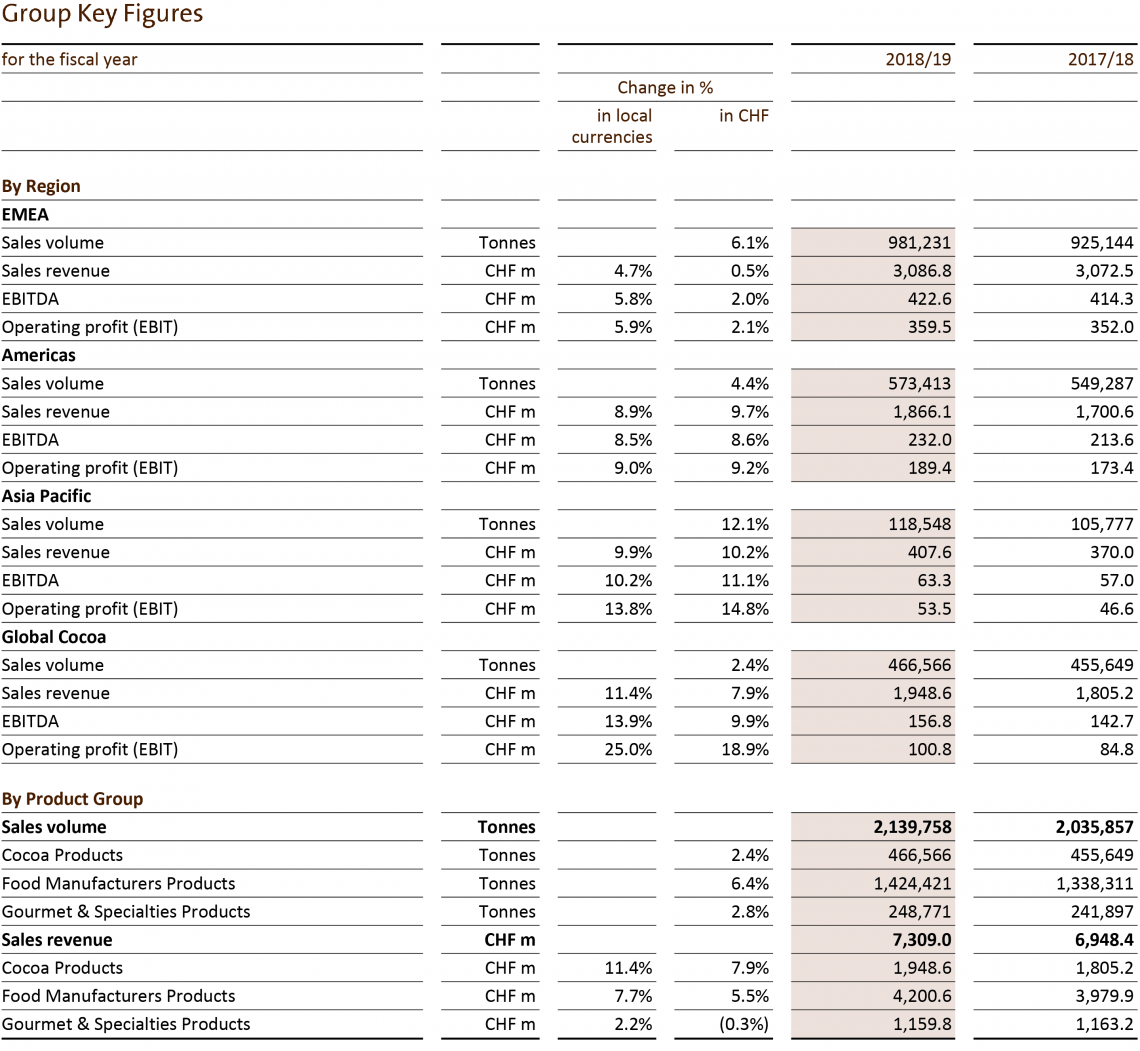

Region EMEA – Strong volume growth and profitability

Barry Callebaut’s sales volume in Region EMEA increased by +6.1% to 981,231 tonnes, with a strong acceleration in the second half of the year. The first-time consolidation of Inforum as of February 2019 contributed to the volume increase. The Region’s organic growth of +3.9% was again clearly above the underlying chocolate confectionery market growth (+1.1%)7. Food Manufacturers continued its healthy sales volume growth in Western Europe, including the ramp-up for Burton’s Biscuit in the UK. Eastern Europe’s organic volume growth continued to be in the double digits. Gourmet maintained its healthy growth. Gourmet & Specialties’ growth was impacted by negative Beverage volume. Sales revenue in EMEA increased by +4.7% in local currencies (+0.5% in CHF) to CHF 3,086.8 million. Operating profit (EBIT) amounted to CHF 359.5 million, an increase of +5.9% in local currencies (+2.1% in CHF), despite the dilutive effect of the first-time consolidation of Inforum.

Region Americas – Healthy growth and strong profitability

Barry Callebaut’s sales volume in Region Americas increased by +4.4% to 573,413 tonnes, well ahead of the regional chocolate confectionery market growth of +1.4%7. Growth momentum built over the year and was supported by Food Manufacturers as well as Gourmet. Sales revenue increased by +8.9% in local currencies (+9.7% in CHF) to CHF 1,866.1 million. Operating profit (EBIT) increased by +9.0% in local currencies (+9.2% in CHF) to CHF 189.4 million, reflecting the healthy growth and the improved product mix.

Region Asia Pacific – Strong growth momentum

Barry Callebaut’s sales volume growth continued its strong momentum in Region Asia Pacific with an increase of +12.1% to 118,548 tonnes, again significantly ahead of the regional chocolate confectionery market (+7.7%)7. Growth was fueled by Food Manufacturers, mostly regional accounts, including the ramp-up for Garudafood. To further fuel growth, the Group deepened its distribution footprint for Gourmet & Specialties in key countries like China. Sales revenue increased by +9.9% in local currencies (+10.2% in CHF) to CHF 407.6 million. Operating profit (EBIT) grew slightly ahead of volumes at +13.8% in local currencies (+14.8% in CHF) to CHF 53.5 million.

Global Cocoa – Further improved profitability

Sales volume in Global Cocoa showed a healthy growth level of +2.4% for the fiscal year under review and amounted to 466,566 tonnes. Sales revenue increased by +11.4% in local currencies (+7.9% in CHF) to CHF 1,948.6 million, supported by on average increased cocoa bean prices. Operating profit (EBIT) improved from CHF 84.8 million in the prior year period to CHF 100.8 million, supported by disciplined execution.

Raw material price developments

During fiscal year 2018/19 cocoa bean prices fluctuated between GBP 1,500 and GBP 1,900 per tonne and closed at GBP 1,709 per tonne on August 30, 2019. On average, cocoa bean prices increased by +4.5% versus prior year. Global bean supply and demand were balanced. World cocoa production further expanded and the good demand for cocoa beans also continued. Côte d’Ivoire and Ghana announced in July 2019 a living income differential (LID) of USD 400 per tonne of cocoa beans, effective as of the 2020/21 crop. Sugar prices in Europe increased during the year (+41.0%), due to a disappointing 2018 crop. In contrast, the world market price for sugar declined by -3.7% due to a production surplus. Dairy prices increased during the fiscal year 2018/19 by +28.9% due to deteriorated production conditions and increased demand.

7 Source: Nielsen, in volume, August 2018 to August 2019 – 25 countries, excluding e-commerce channels.

Proposals to the Annual General Meeting (AGM)

Payout to shareholders

The Board of Directors is proposing a payout to shareholders of CHF 26.00 per share at the Annual General Meeting of Shareholders on December 11, 2019, an increase of +8.3% versus prior year. This represents a payout ratio of 39% of the net profit. The dividend will be paid to shareholders on or around January 8, 2020, subject to approval by the Annual General Meeting of Shareholders.

Board of Directors

Jakob Baer, Vice-Chairman, Board member since 2010 and Chairman of the Audit, Finance, Risk, Quality & Compliance Committee (AFRQCC), and Juergen Steinemann, Board member since 2014 and member of the Nomination & Compensation Committee (NCC), have decided to step down from their respective functions. The Board of Directors would like to express its sincere gratitude to Jakob Baer for his competent guidance, especially in topics related to accounting and governance during a phase of steep growth and global expansion for Barry Callebaut, and to Juergen Steinemann for his outstanding contribution to the further development of the company thanks to his deep industry knowledge combined with a fine sense for people matters.

All other members of the Board – Patrick De Maeseneire (Chairman), Fernando Aguirre, Suja Chandrasekaran, Angela Wei Dong, Nicolas Jacobs, Elio Leoni Sceti, Timothy Minges and Markus Neuhaus – will stand for reelection for another term of office of one year. Markus Neuhaus will be proposed to the Board as Vice-Chairman.

Further information is available in the following publications available as of today:

Gerelateerde downloads

Media and Analysts / Institutional Investors’ conferences of the Barry Callebaut Group

|

Date: |

Wednesday, November 6, 2019 |

|

Location: |

Barry Callebaut Head Office, CHOCOLATE ACADEMYTM Center, |

|

Time: |

Media: 09.30 am to 10.30 am CET Analysts/Institutional Investors: 11.30 am to approx. 1 pm CET (followed by light lunch) |

|

The conference can be followed via telephone or audio webcast. |

Financial Calendar for Fiscal Year 2019/20 (September 1, 2019 to August 31, 2020)

|

Annual General Meeting 2018/19 |

December 11, 2019 |

|

3-Month Key Sales Figures 2019/20 |

January 22, 2020 |

|

Half-Year Results 2019/20 |

April 16, 2020 |

|

9-Month Key Sales Figures 2019/20 |

July 9, 2020 |

|

Full-Year Results 2019/20 |

November 11, 2020 |

|

Annual General Meeting 2019/20 |

December 9, 2020 |

Media assets

-

Barry Callebaut CEO Antoine de Saint-Affrique

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2019-11/Barry%20Callebaut%20CEO%20Antoine%20de%20Saint-Affrique.jpg?itok=sMv1HKii -

Barry Callebaut CFO Remco J. Steenbergen

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2019-11/Barry%20Callebaut%20CFO%20Remco%20Steenbergen.jpg?itok=Ospp47Yw -

Barry Callebaut Cacaofruit Experience and Wholefruit Chocolate

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2019-11/Barry%20Callebaut%20Cacaofruit%20Experience%20and%20Wholefruit%20Chocolate.jpg?itok=KYlG3KoM -

Barry Callebaut Cacaofruit Wholefruit Chocolate

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2019-11/Barry%20Callebaut%20Cacaofruit%20Wholefruit%20Chocolate.jpg?itok=1cSrCDyC -

Barry Callebaut Ruby Chocolate Volcanos

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2021-07/Barry%20Callebaut%20Full%20Year%20Results%20Fiscal%20Year%202018-2019_0_0.jpg?itok=3khGyjxr -

Barry Callebaut Dark Milk Ruby White Chocolate

https://www.barry-callebaut.com/sites/default/files/styles/paragraph_image_gallery_full/public/2019-11/Barry%20Callebaut%20Dark%20Milk%20Ruby%20White%20Chocolate.jpg?itok=9oYWDEEi

Media/Analyst Conference Presentation

Barry Callebaut Group Short Report 2018/19

Barry Callebaut Group Annual Report 2018/19

About Barry Callebaut Group

With annual sales of about CHF 7.3 billion (EUR 6.5 billion / USD 7.4 billion) in fiscal year 2018/19, the Zurich-based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The two global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.