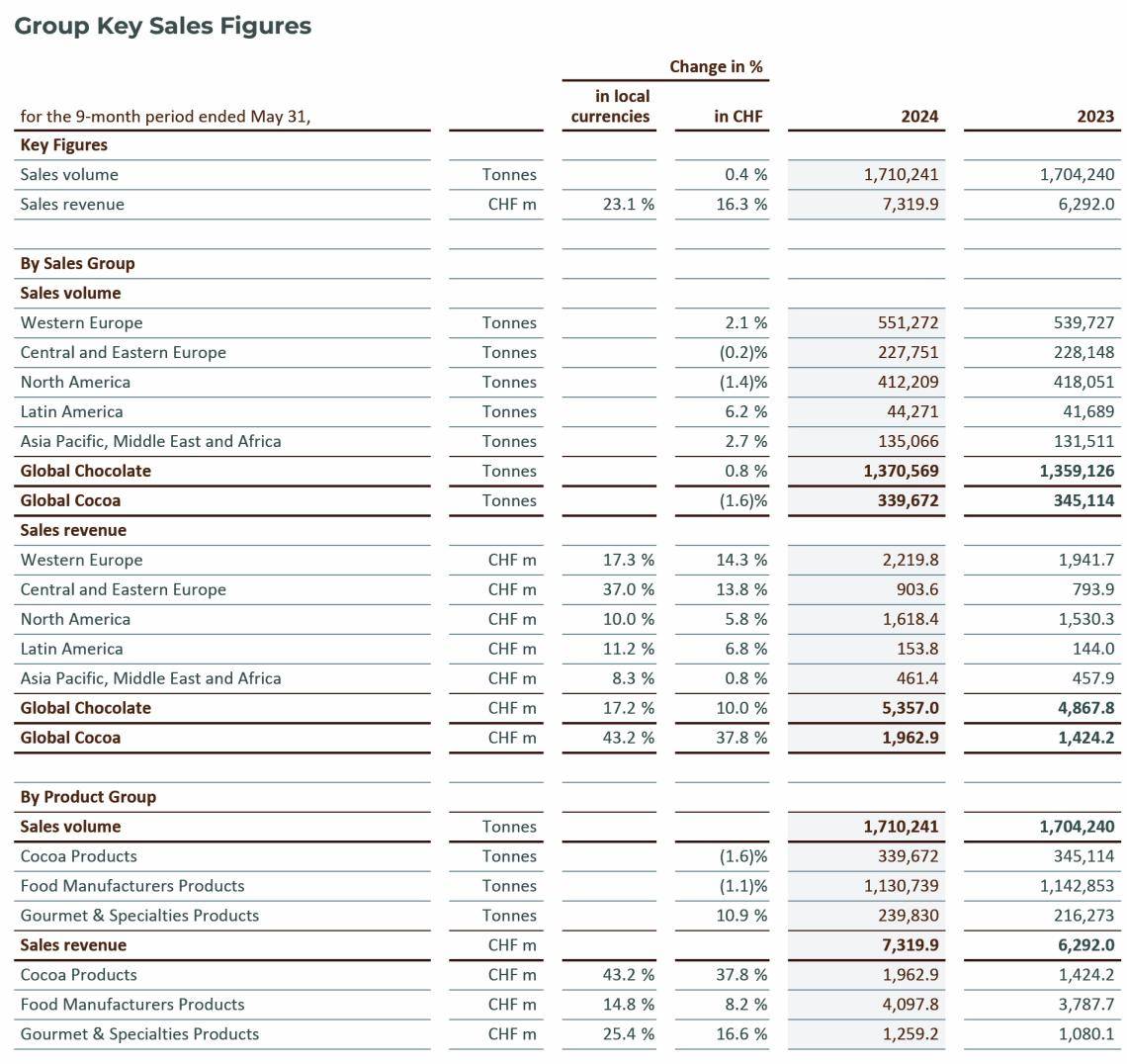

The Barry Callebaut Group reported sales volume of 1,710,241 tonnes, up +0.4%, during the first nine months of the fiscal year 2023/24 (ended on May 31, 2024). Sales volume was down -0.3% in the third quarter, in the context of a challenging market environment.

Global Chocolate saw +0.8% volume growth in an overall declining chocolate confectionery market according to Nielsen (-1.5%)2. Volume development for Food Manufacturers (-1.1%) remained suppressed as large global customers saw softer demand, partly offset by resilient performance for Private Label customers. Gourmet & Specialties delivered +10.9% volume growth with strong demand across most geographies and market segments. In the third quarter, the Gourmet business saw a positive impact from the phasing of customer purchases in a rising cocoa price environment.

Most Global Chocolate regions saw positive volume growth. Western Europe (+2.1%) was the largest contributor, with positive growth for Food Manufacturers and strong momentum for Gourmet. Volume growth in Asia Pacific, Middle East and Africa turned positive (+2.7%), with close to double-digit growth in the third quarter supported by improved performance in Indonesia. Latin America saw solid volume growth of +6.2% in the first nine months, led by Gourmet in Brazil. North America reported a sales volume decrease of -1.4%, as large Food Manufacturers saw lower demand, while regional accounts and Gourmet continued to see resilient growth. Volumes declined slightly in Central and Eastern Europe (-0.2%), with a slowdown in the third quarter impacted by lower volumes for certain large global and regional customers.

Global Cocoa saw a -1.6% decrease in sales volume, in the context of a significant increase in cocoa prices. The supply constrained environment impacted sales for cocoa butter and cocoa liquor, particularly in the third quarter. Demand for cocoa powder remained robust, with particular strength in India and Indonesia. Overall, global customers saw volume pressure, partly offset by solid momentum for regional customers.

Sales revenue amounted to CHF 7,319.9 million, an increase of +23.1% in local currencies (+16.3% in CHF), ahead of volume growth. Growth was driven by the significant increase in cocoa prices, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

2 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2023 - April/May 2024. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

Refinancing measures

The significant increase in cocoa prices over recent months has heightened working capital requirements for the entire industry. In addition to the financing actions Barry Callebaut has already taken in the first half of the year, the Group took further steps to address this development in the third quarter. In May, the Group successfully re-entered the Swiss bond capital market issuing a CHF 730 million triple-tranche senior bond. The issuance consisted of a two-year tranche of CHF 240 million, a six-year tranche of CHF 270 million and a ten-year tranche of CHF 220 million. The Group also placed a new EUR 700 million bond in June, with a tenor of five years. These additional financing measures will increase flexibility and help to mitigate higher cash requirements in bean sourcing.