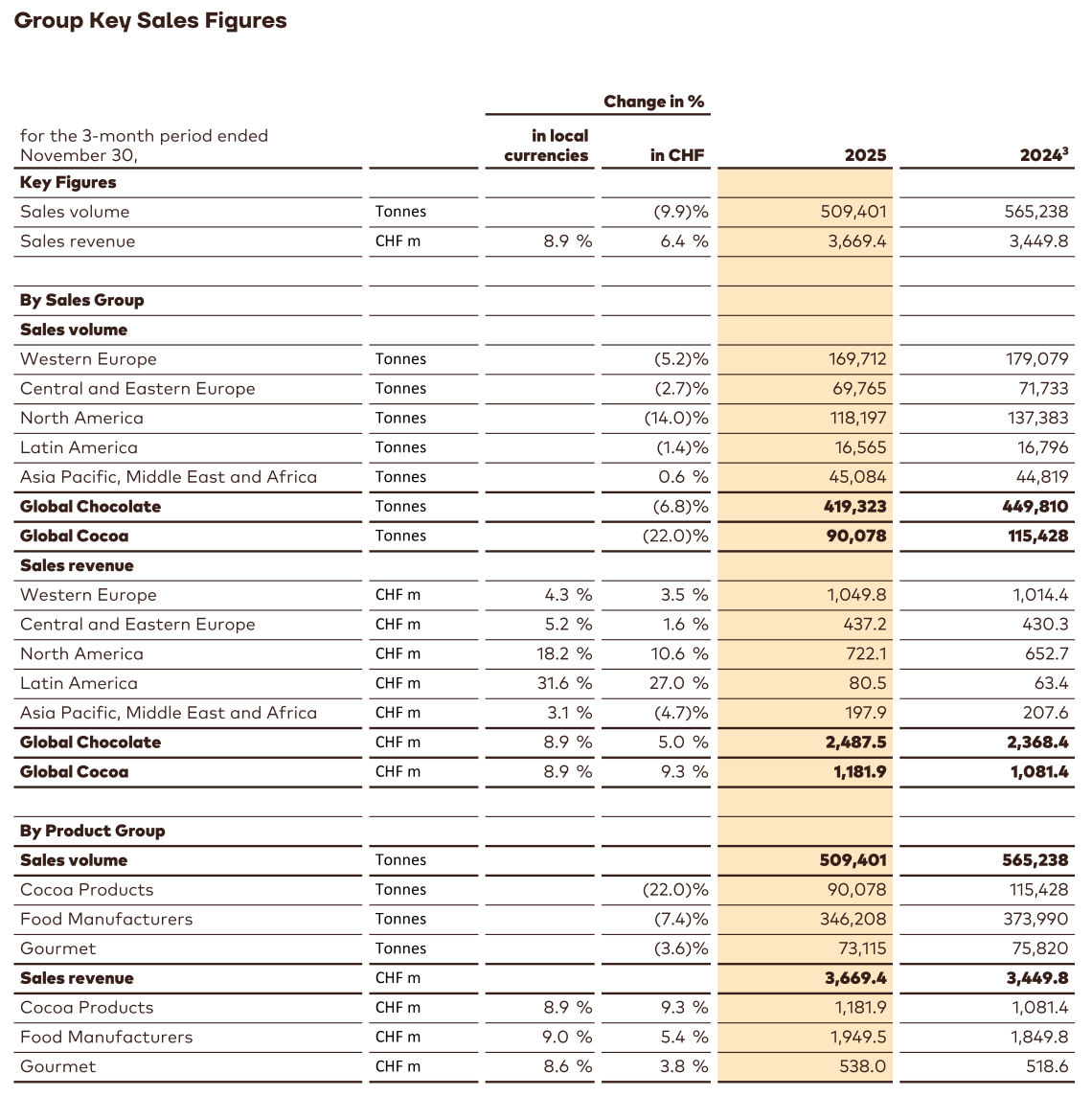

Global Chocolate saw a -6.8% volume decrease, in the context of a declining chocolate confectionery market according to Nielsen (-6.1%)2. Volume development in Food Manufacturers (-7.4%) was impacted by the negative market dynamics as customers adapted behaviors in the context of high prices, as well as by the temporary suspension of production at the St. Hyacinthe plant in Canada. Volumes in Gourmet were more resilient, decreasing by -3.6% as customers reduced elevated stock levels in a high price and competitive environment as well as some impact from the St. Hyacinthe plant pause.

Looking at regional performance within Global Chocolate, Asia Pacific, Middle East and Africa (AMEA, +0.6%) was the strongest contributor. Volume growth in AMEA was driven by improved demand in China, market share gains and momentum in India and additional business secured in Australia, partly offset by market pressure in Japan and South Korea. Latin America saw slightly negative volume growth (-1.4%) as strong momentum in Gourmet was offset by more challenging dynamics for large Food Manufacturers navigating higher prices. Central and Eastern Europe (-2.7%) was impacted by lower volumes for large Food Manufacturer customers, while local accounts saw solid growth especially in Türkiye. Western Europe reported a -5.2% volume decrease as higher prices resulted in demand softness and influenced customer behavior. Volume development in North America ( -14.0%) was impacted by the temporary suspension of production at the St. Hyacinthe plant in Canada due to a technical malfunction which is now resolved, as well as a challenging customer environment.

Sales volume for Global Cocoa declined by -22.0%. The business was impacted by negative market demand, particularly in AMEA, as well as the prioritization of volume towards higher return segments.

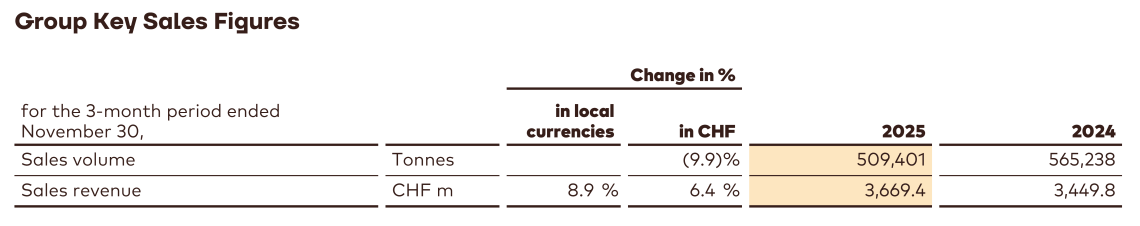

Overall, the Barry Callebaut Group reported sales volume of 509,401 tonnes (-9.9%) during the first three months of fiscal year 2025/26 (ended November 30, 2025).

The Group continues to capture strategic growth opportunities and leverage innovation across the entire spectrum of chocolate solutions, to fuel future growth. Cacao coatings (compound) continued to attract interest from customers with around 600 R&D projects currently underway. Cacao coatings saw flat growth in the first three months of the year, demonstrating particularly good momentum for super compound products. Barry Callebaut is also exploring non-cocoa solutions with ChoViva - the world’s leading chocolate alternative without cocoa. The phased international commercial roll out is in process, aligning local and global partnerships, production and distribution as well as go-to-market strategies to ensure a scalable and sustainable launch beyond Europe.

Sales revenue amounted to CHF 3,669.4 million, an increase of +8.9% in local currencies (+6.4% in CHF). The increase was driven by higher year-on-year cocoa pricing, which is sequentially stabilizing given the recent lowering of cocoa bean prices.

2Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2025 - October/November 2025. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.